India unveiled a bigger budget of 39.45 trillion rupee ($529.7 billion) for the coming fiscal year on Tuesday, stepping up investment on highways to affordable housing to put growth on a firmer footing as the economy recovers from the pandemic.

India unveiled a bigger budget of 39.45 trillion rupee ($529.7 billion) for the coming fiscal year on Tuesday, stepping up investment on highways to affordable housing to put growth on a firmer footing as the economy recovers from the pandemic.

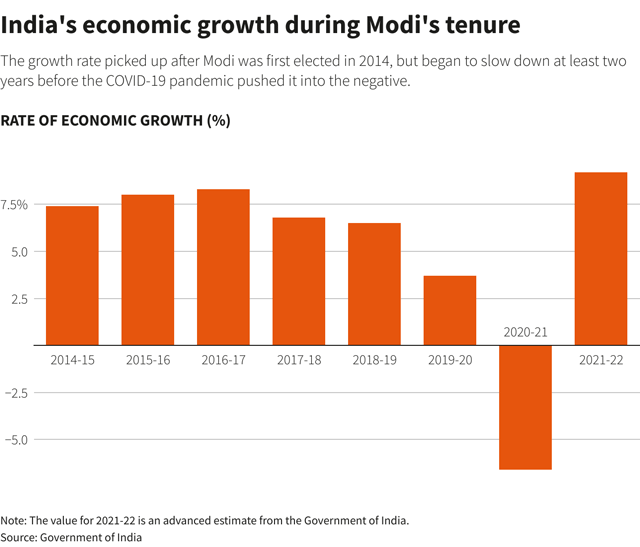

The government has projected slower economic growth of 8% to 8.5% compared with an estimated 9.2% for the current fiscal year. GDP contracted 6.6% the previous year.

"The overall sharp rebound and recovery of the economy is reflective of our country's strong resilience," Finance Minister Nirmala Sitharaman said, vowing to lay the foundation for faster growth.

She announced spending of 200 billion rupees ($2.68 billion) for a highway expansion programme and said 400 new trains would be manufactured over the next three years. Total government spending will be 4.6% more than the current year.

The fiscal deficit for the current year would be 6.9% of GDP, slightly more than the 6.8% targeted earlier, Sitharaman said.

For the next fiscal year, India is targeting a deficit of 6.4% of GDP, hoping to build on higher tax revenues and privatisation of state firms including a share sale of giant insurer Life Insurance Corporation of India (LIC).

Prime Minister Narendra Modi's government has made building of physical and digital infrastructure a top priority to improve the cost of doing business.

"The touchstone of the master plan will be world-class, modern infrastructure and logistics synergy among different modes of movement of both people and goods, and location of projects," Sitharaman said.

She said the central bank would introduce a digital currency in the next fiscal year using blockchain and other supporting technology.

"Introduction of a central bank digital currency will give a big boost to the digital economy. A digital currency will also lead to a more efficient and cheaper currency management system," Sitharaman said.

India's central bank has voiced "serious concerns" around private cryptocurrencies on the grounds that these may cause financial instability.

Indian 10-year benchmark bond yield rose to 6.7649% after the government said the fiscal deficit for 2021/2022 would be bigger than expected. The blue-chip stock NSE Nifty 50 and S&P BSE Sensex stock indexes jumped nearly 1.5% on a boost in capital expenditure.

The rupee was slightly stronger at 74.54 against the dollar as of 0654 GMT.

"The fiscal outcome is broadly in line with our expectations with the government having continued its focus on infrastructure and rural demand," said Upasna Bhardwaj, senior economist at Kotak Mahindra Bank.

"As expected, the government has refrained from a sharp consolidation. While the fiscal expansion is expected to be pro-growth, the heavy supply is expected to worry the bond markets."

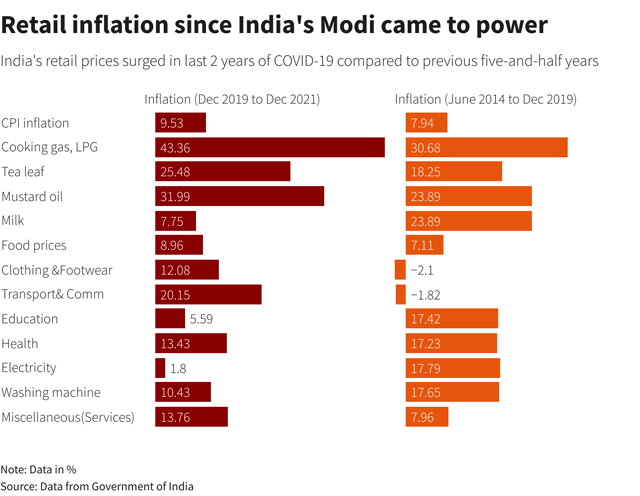

Concerns have also risen about inflation and loss of tens of thousands of jobs because of the disruptions caused by the pandemic. Sitharaman expressed empathy with those who had to bear adverse health and economic affects of COVID-19 that devastated India during the second wave last year.

A government report on Monday warned that growing risks of global inflation led by rising crude oil prices could hit the economy.