The valuation of Asian shares surged to a more than 10-1/2-year high in July, Refinitiv data showed, as record-low interest rates and abundant government stimulus helped offset worries over the economic impact of the COVID-19 pandemic.

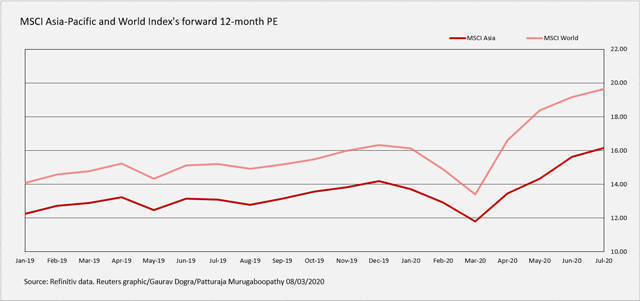

MSCI's broadest index of Asia-Pacific shares rose 4.29% last month, recording its fourth straight monthly gain. The index's 12-month forward price-to-earnings (P/E) ratio was at 16.15, the highest since December 2009, the data showed.

Meanwhile, MSCI's gauge of stocks across the globe climbed 5.14% in July, lifting its P/E ratio to 19.65, the highest since at least June 2003.

Lower interest rates, stimulus support from regional governments and retail investors' increased participation in stock markets have bolstered the valuation of regional indexes this year, analysts said.

Hopes that vaccines against the COVID-19 disease might be ready by the end of the year also supported the risk-on trade in regional markets.

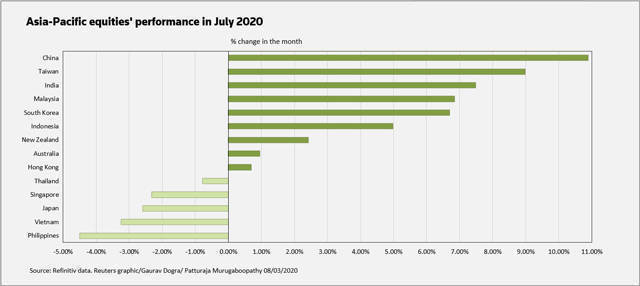

China's benchmark stock index surged 10.9% in July, recording its best monthly rise since February 2019, and topped regional gains.

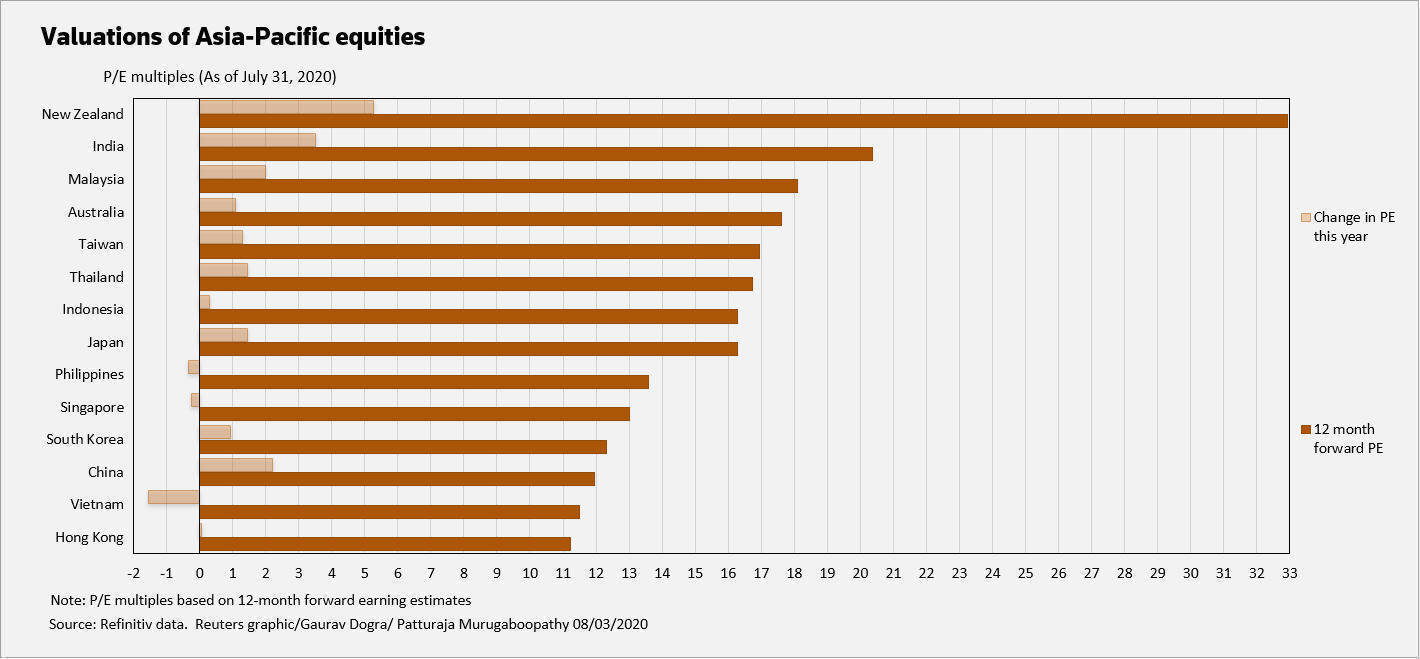

Simona Gambarini, markets economist at Capital Economics, said the higher P/E ratios of mainland China equities, which have been driven higher by a government-sanctioned wave of retail speculation, do not yet suggest signs of trouble.

"One reason why we wouldn't put too much emphasis on high P/E ratios in general is that earnings are distorted by the impact of the pandemic, which has been very large but will probably also prove short lived," Gambarini said.

New Zealand, India and Malaysia shares were the most expensive in the region, with P/E ratios of 32.93, 20.36 and 18.11, respectively.

Taiwan equities hit a record high of 13,031.7 in July and gained about 9% last month, the biggest monthly rise after China.