Foreign investors are buying Asian shares after dumping them over the past three months, as lifting of coronavirus lockdowns has boosted optimism regional economies are set for recovery.

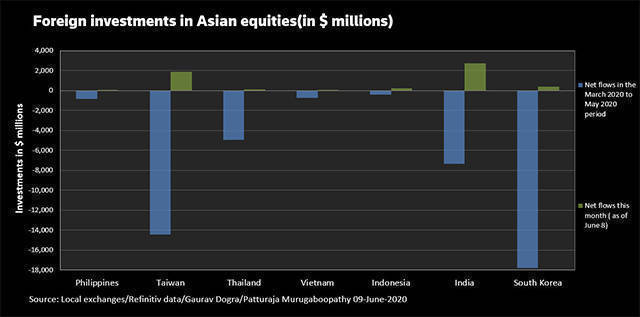

Overseas investors bought $5.45 billion worth of regional equities in the first six trading days of this month, data from stock exchanges in India, Indonesia, the Philippines, South Korea, Taiwan, Thailand and Vietnam showed.

They sold $46.45 billion between March and May, which hit regional currencies and raised fears that some countries dependent on external financing to fund their current account deficits would come under further pressure.

"The picture has certainly improved into June as May economic indicators suggested a bottoming of the COVID-19 drag, instilling a sense of hope and powering Asia markets that tend to benefit with such recovery momentum," said Jingyi Pan, a Singapore-based market strategist at financial services firm IG.

Pan said Asian markets were able to catch-up to their U.S. counterparts as Washington's reaction to Beijing's new national security law for Hong Kong was not as bad as feared.

The MSCI's broadest index of Asia-Pacific shares has gained about 6.5% this month, tracking the rally in global shares which climbed about 6.7%, as of Monday's close.

Indian equities led the region with inflows of $2.76 billion worth of foreign money so far this month, while Taiwan received $1.88 billion.

An increase in U.S.- nonfarm payrolls last month added to optimism this week as governments around the world started to lift tough lockdown measures imposed to contain the coronavirus which has infected 7.1 million people and killed 406,225.

The increase in foreign buying was also due to a slump in global interest rates as major central banks unleash stimulus to revive their economies, analysts said.

"With massive expansion of major central bank balance sheets and activity starting to recover as restrictions in the region ease, we should start to see inflows return," said Khoon Goh, head of Asia research at ANZ.