The size of the alternative investment fund industry in the country is likely to more than double over the next two to three years, thanks in part to favourable policies, panellists at the VCCircle India Limited Partners Summit said on Tuesday.

The size of the alternative investment fund industry in the country is likely to more than double over the next two to three years, thanks in part to favourable policies, panellists at the VCCircle India Limited Partners Summit said on Tuesday.

During a discussion at the ninth edition of the summit, panellists hailed the central government for key policy changes, such as the tax pass-through status to AIFs, made in a bid to boost fund-raising through this route.

“The government is bringing in very encouraging changes to the private equity and venture capital space in India. It has taken a huge development role for the startup community, which no previous governments have done. And all this has brought in a lot of optimism in the industry,” said Gopal Srinivasan, chairman and managing director at private equity firm TVS Capital Funds Ltd and chairman of industry body Indian Private Equity and Venture Capital Association (IVCA).

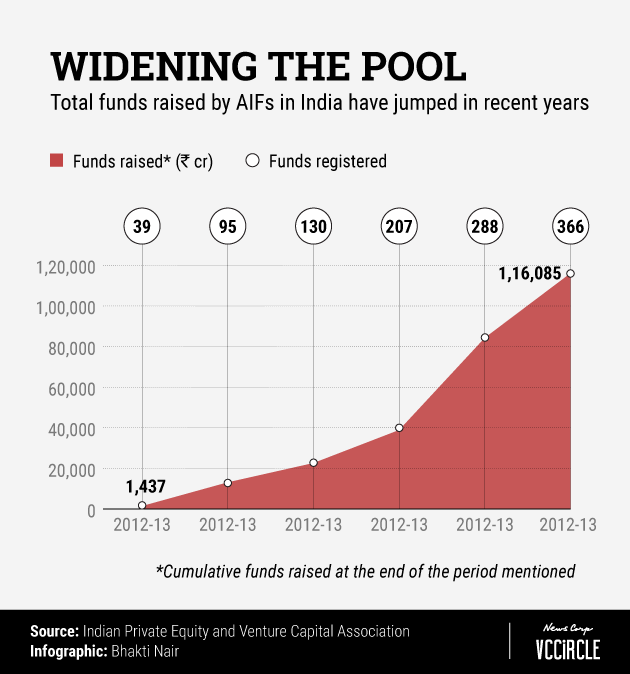

According to an IVCA presentation before the panel discussion, the total funds raised by private equity and venture capital funds increased to Rs 1.16 trillion ($20 billion) at the end of September 2017 from Rs 1,437 crore in 2012-13. The total fundraise can rise to Rs 3 trillion by the end of 2019-20 if more favourable policy measures are taken, it said.

The IVCA said that PE and VC fundraising jumped five times since the end of 2014-15. In 2015 February, the Budget proposed a tax pass-through for Category-I and Category-II AIFs, meaning that capital gains arising from alternative investments would be taxed in the hands of investors instead of those funds. Category-I AIFs include VC funds, infrastructure funds and social venture funds while Category-II AIFs include private equity funds and debt funds, according to the Securities and Exchange Board of India’s classification.

The panellists said that one key policy change that PE/VC firms expect is doing away with the 18% goods and services tax (GST) currently applicable to onshore foreign pool of capital.

“An 18% GST is a huge haircut for GPs operating in India that needs to be done away with. Besides, safe-harbouring rule will give huge impetus to investments here,” said Gautam Mehra, leader of tax and regulatory services at PricewaterhouseCoopers (PwC).

Mehra said the perception of global investors has changed in the past three years. Businesses that looked sceptically at India because of past tax controversies such as the general tax anti-avoidance rules now feel differently, he said.

“A few years ago, there was a threat of foreign fund managers moving out of India due to tax regulations. But tax treaties changed, offering further push to AIFs,” Mehra said, adding that real estate investment trusts will also see investor interest.

Mehra also highlighted five T’s for the industry’s growth—transparency, track record, talent for sustainability, time and terms of deal-making.

Gaurav Kapoor, senior private sector development adviser at the UK Department for International Development in India, said that agriculture, health, education and renewable energy sectors offer great investment opportunities.

According to him, AIFs need to focus on segmentation from the point of view of having more products and a variety of products. “Success needs to be looked at from a negative connotation. That is failure and embracing it for future learning,” Kapoor said.