Mumbai resident Shivam Vahia cannot remember the last time he left home to shop. He spends about 30,000 rupees ($364) a month buying necessities like groceries, clothes and gadgets, all by tapping a few buttons on his mobile phone.

"My only offline spends are bars and restaurants, when I go to meet friends," said the 24-year-old engineering graduate.

Vahia is one among India’s young and aspirational 1.4 billion population, whose propensity for online spending has attracted global companies and digital platforms. And as private consumption underpins economic growth in India, financial investors are targeting new ways to tap into it.

China saw a jump in consumption from 2006 when, as per World Bank data, its per capita gross domestic product (GDP) crossed $2,000. India crossed that threshold in 2021, according to the bank's latest available data, which could put it on a similar growth trajectory even though weak job growth and income inequalities in the country pose a risk to this outcome.

With the cheapest mobile data rates in the world, thanks to intense competition among telecoms providers, and the explosive growth of social media and personal entertainment, Indian consumers are going digital at a breakneck pace.

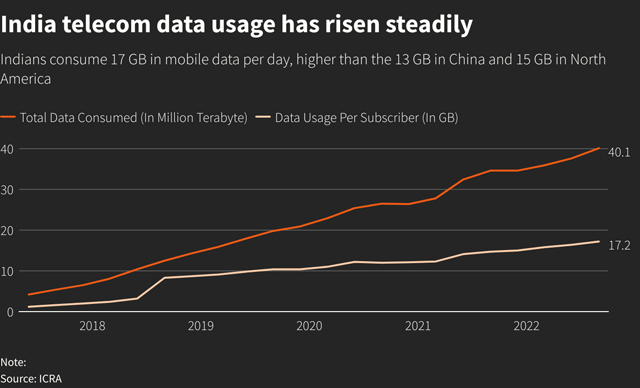

It has nearly 700 million smartphone users, who, rating agency ICRA estimates, consume an average of almost 17 GB in mobile data per day, higher than the 13 GB in China and the 15 GB in North America.

"An urban consumer in India can see what consumers are consuming in developed countries and a rural consumer can see what an urban consumer is doing. This aspiration-led consumption boost has the potential to provide a material fillip to discretionary consumption in years to come," said Priyanka Khandelwal, fund manager at ICICI Prudential Asset Management.

Physical to digital

For investors, not only new-age Indian tech companies but also traditional consumer firms that are adding digital capabilities offer a route to tap the consumption theme.

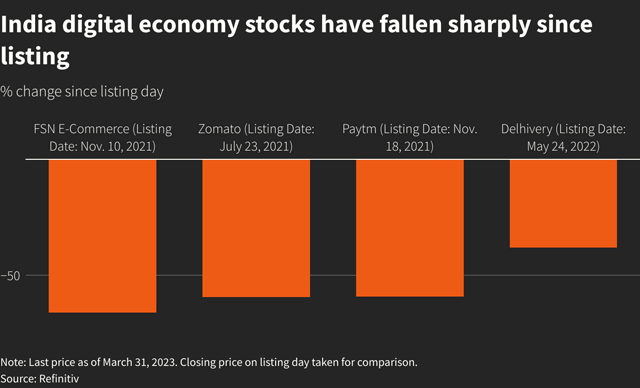

Opportunities for gaining exposure poured in for them when platforms that cater to online commerce, including food delivery specialist Zomato, FSN E-Commerce Ventures, which runs beauty and fashion sales platform Nykaa, SoftBank-backed logistics firm Delhivery, and payment firm Paytm, listed recently in the Indian markets.

Bain & Co estimates that India's online shopping market hit $50 billion in 2022, with an online shopper base of 180-190 million - the third largest in the world after China and the U.S.

"Investors can play the online and digital consumption boom in India directly via the tech companies enabling this space, or indirectly via supported industries such as logistics or fintech," said Kunjal Gala, head of global emerging markets at Federated Hermes.

Traditional businesses currently suffering from poor penetration and low per capita usage offer another promising avenue for investors.

India's per capita consumption of food was at $314 in 2020 compared to $884 for China, while that of clothing stood at $53.9 versus $212.9 for China, data from CLSA showed. Per capita spending on health related items in India was $56.8 in 2020 and $389.3 for China, the data showed.

"A pattern will continue to repeat for years in India: industry after industry emerging from a long period of under-penetration" and moving up the per capita consumption scale, said Vikas Pershad, portfolio manager for Asian equities at M&G Investments.

"The range of industries will span healthcare delivery (hospitals) to cars and two-wheelers to housing finance companies and cement."

As the incomes and wealth of Indians rise, their aspirational needs will see demand ramp up for packaged food and beverages, branded goods, travel, preventive healthcare, and personal care, said ICICI Prudential's Khandelwal and the fund's chief investment officer S Naren.

Foreign investors jump in

With private consumption accounting for 60% of India's $3.5 trillion GDP, foreign portfolio investors have been quick to latch on.

They pumped in a net $2.7 billion in four key consumption sectors - automobiles, consumer durables, consumer services and FMCG, in the first 11 months of the financial year 2022-23 (April-March), according to data from India's National Securities Depository Ltd.

In contrast, the broader Indian equity markets saw an outflow of $5.9 billion.

To be sure, it has not been all smooth sailing for investors as they chased India's consumption boom. Shares of the new-age technology companies have tumbled since their listings, and while they now trade at more reasonable valuations, they are still pricey compared to the industry median.

And most traditional consumer-focused companies also trade at valuations above the benchmark index.

Indian equities remain quite expensive both on a historical and relative basis, compared to China, for instance, said David Chao, global market strategist at Invesco Asia Pacific, who sees "outsized" growth in segments like quick service restaurants and consumer durables.

But investors have to look beyond that, he said. "To be an investor and make money in India, you have to take a longer time horizon."