The Covid-19 pandemic has completely disrupted and reset the investment cycle in India, and a plethora of policies and incentives are being announced to make the country Atma Nirbhar, or self-reliant.

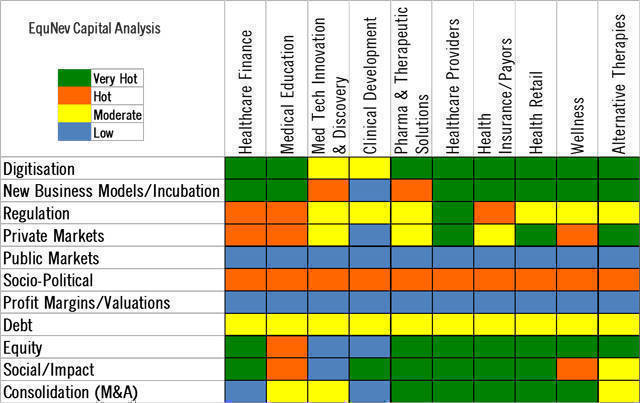

In January, when we published our annual investment heat map for 2020, there was an imminent slowdown and the mood was negative across the healthcare and life sciences sub-sectors. Our outlook also included social finance and factored the Social Stock Exchange, for which draft regulations are out in the public domain.

As the economy opens up, investment sentiment across the sub-sectors is bouncing back due to geopolitical realignment, a China substitution policy and a wave of digital business models. The key risk here is cross-border relations.

While there is erosion of cash flows of very established players, there is a significant need for investments to sustain the current operations and also invest into newer growth opportunities that Covid-19 has presented.

Our revised heat map provides a snapshot of how the investment cycle is gearing up with increased pipeline of deals and investment flows. Markets have already recovered and factored this in their pricing.

Based on the revised heat map for the year up to June 2021, let’s look at the broad trends in terms of investment activity and trends.

Healthcare financing

The speed of digitisation accelerates the ‘India Stack’ project to reach the consumer faster with innovative financing products. Innovation in products and services for consumer financing of healthcare will see more players emerge.

Many existing players are reworking their value proposition and plan to provide innovative products and services, thus increasing coverage in 2020. However, as demand accelerates, risk underwriting is equally important to avoid delinquency.

- Post-Covid Outlook: Very Hot

- What’s going wrong: Regulation, maturity to scale, right bite for the consumers, reach and penetration, debt financing costs

- What’s going right: India Stack digitisation, consumer borrowing to spend on electives, immediate gratification, reduced savings due to lower earnings during lockdown

Medical education

The shortage of frontline healthcare workers was very apparent during the Covid-19 crisis. The need for a regulatory regime to improve skills is still being reworked. Healthcare could be the key job creator. Regulatory reforms are urgently required to push digitization and newer business models for upskilling existing workforce.

Many debt servicing issues of the sector continue to persist with a few more bankruptcy cases. A lot more exits and a churn in ownership of assets are expected due to consolidation activity.

- Post-Covid Outlook: Moderate

- What’s going wrong: Regulation, corruption, no vision, skill shortages, alignment to new-age care, increasing debt burden, new-age skills certification, funding dry up

- What’s going right: Skill demand, NCLT closures, digitisation

Med-tech innovation, life sciences discovery and clinical development

The pipeline for moving into clinical development in 2020 has completely pivoted towards Covid-19-related solutions and of a global scale.

Investments will be selective in opportunities for Covid-19-related therapeutic solutions. Social innovation would be the way forward.

- Post-Covid Outlook: Medium

- What’s going wrong: Innovation pipeline, IP regulation, regulatory bottlenecks on clinical development, newer skill sets for research and acceleration

- What’s going right: Talent supply, cost advantage, emerging social innovation models

Pharmaceutical and therapeutic solutions

In the post-Covid-19 world, M&A and consolidation activity have spiked. Digitisation will be a key driver in 2020. Mega investment rounds of some e-pharmacies that we predicted has already occurred during this crisis.

Some social impact models to counter the bottom-of-the-pyramid need gaps are emerging. It will not get mainstream in 2020 as China substitution and supply chain issues need to be resolved urgently.

- Post-Covid Outlook: Hot

- What’s going wrong: Price controls, policy logjam, wrong product portfolio, innovation and scale up, global or China-level cost competitiveness

- What’s going right: Cost advantage, distribution infrastructure, digital business models

Healthcare providers

The funding and liquidity crisis has deepened due to the lockdown. Newer delivery models and hospitals of the future with an asset-light strategy will emerge as costs build up and prices remain under pressure.

There will be a huge churn in asset ownership and consolidation activity. There will be no major action on public-private-partnership front. The telemedicine guidelines will accelerate digital business models.

- Post-Covid Outlook: High

- What’s going wrong: Margin pressures, price controls, GST slabs rationalization on inputs, execution of programmes on the ground, PPP in healthcare, supply and demand mismatch in micro markets, debt financing costs, gun powder churn, operating cash runway

- What’s going right: Digital business models augmentation

Healthcare insurance

There is a liquidity crisis due to a moratorium on renewals till October 2020. Innovative models for healthcare payers will emerge in India for the middle bulge of India Stack for the 500 million people that are paying out of pocket.

As loss ratios will further mount, the insurance rate will go northwards. Innovative products and pricing is still a distant reality with the regulator in India.

- Post-Covid Outlook: Medium

- What’s going wrong: Margin pressures, product fit to consumer needs, product approvals, loss ratios, slow pace of innovation, operating cash runway

- What’s going right: Consumer demand, digitisation

Health retail

Muted consumer demand and discretionary spending due to disposable income growth will result in slower growth and pick-up in gross merchandise value (GMV). Valuations will be a key issue. Consolidation and acquisitions are expected for some to survive and grow. Venture capital and private equity interest is getting revived.

- Post-Covid Outlook: High

- What’s going wrong: Regulation, maturity to scale, slower consumer spending, operating cash runway

- What’s going right: India Stack digitisation

Wellness

Discretionary consumer spending on wellness will pick up due to fear of Covid-19. Mass-market, moderately-priced wellness products and business model innovation are still lagging behind. Revival in growth is expected only after the third quarter in 2020 when services open up fully.

- Post-Covid Outlook: Moderate

- What’s going wrong: Regulation, maturity to scale, new mass market business models

- What’s going right: India Stack digitisation, Fit India

Alternative therapies

The Babas promoting alternative therapies have been coming up with Covid-related products and its controversies. MNCs and local businesses have entered this segment, affecting their market share and position. Consumer adoption will accelerate as these products become the only choice.

- Post-Covid Outlook: Moderate

- What’s going wrong: Maturity to scale, consumer education and confidence, clinical research, new product development

- What’s going right: India Stack digitisation, consumer spending on health and wellness

Stay safe and happy investing in the rest of 2020.

Kapil Khandelwal is managing partner of healthcare infrastructure fund Toro Finserve LLP and director at EquNev Capital Pvt Ltd.