At a time when banks have tightened their purse strings to tackle bad loans, Indian non-banking finance companies (NBFCs) are growing their heft even as India Inc at large is yet to get back on an investment drive.

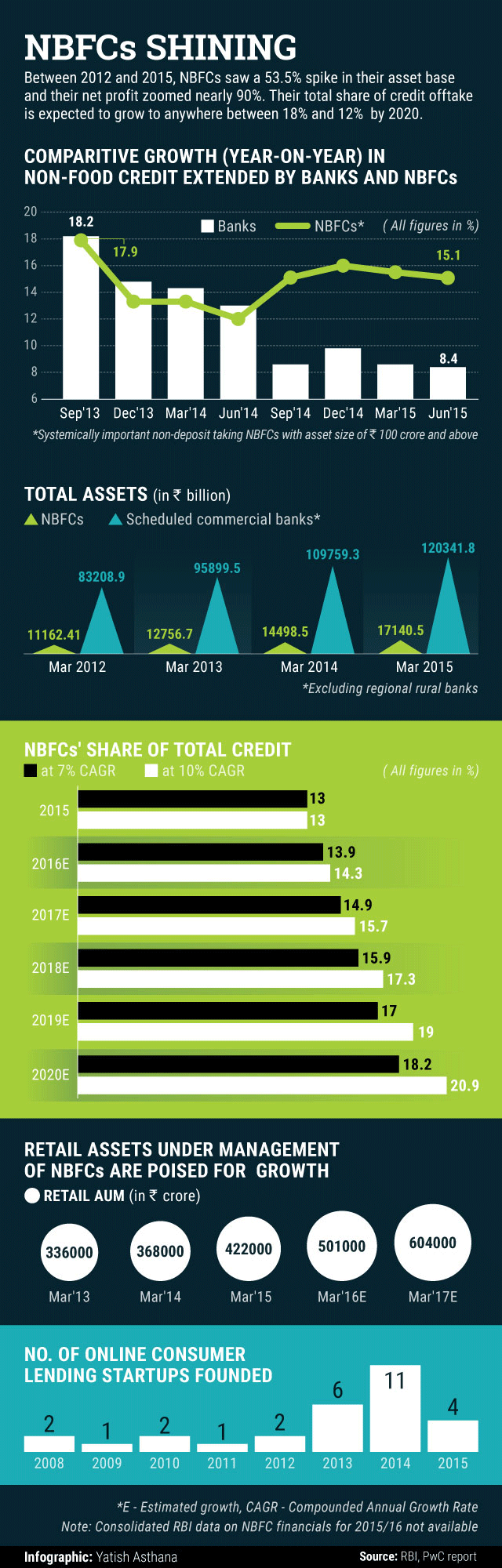

A look at the non-food credit data compiled by Reserve Bank of India (RBI) shows how NBFCs have started moving at twice the pace of the banks. An inflection point was reached around September 2014, when, for the first time in recent times, NBFCs surpassed scheduled commercial banks in terms of year-on-year credit growth (see infographic).

Although NBFCs are still small in terms of outstanding credit, at an annualised growth rate of over 15%, they are slowly making their way into balance sheet of companies, especially those in the small and medium size category and in the real estate business irrespective of size.

In August, the union cabinet approved foreign direct investment (FDI) under the automatic route in regulated NBFCs. But private equity investors have been lapping on to NBFCs even before that. There have been at least three transactions valued in excess of $100 million this year alone, according to VCCEdge, the data research platform of News Corp VCCircle.

In February, PE firm Kedaara Capital and Swiss investment firm Partners Group bought the housing finance arm of Au Financiers. A month later, AION Capital Partners backed Pramod Bhasin and Anil Chawla to acquire GE’s commercial finance business in India and in July, UK government-owned CDC Group bought a 15.5% stake in Indian Infoline Finance Ltd for around $150 million.

A report released earlier this year by consulting firm PwC India said by 2020, credit lending by Indian NBFCs is expected to account for anywhere between 18.2% and 20.9% of the total credit off-take in the country.

Like this report? Sign up for our daily newsletter to get our top reports.