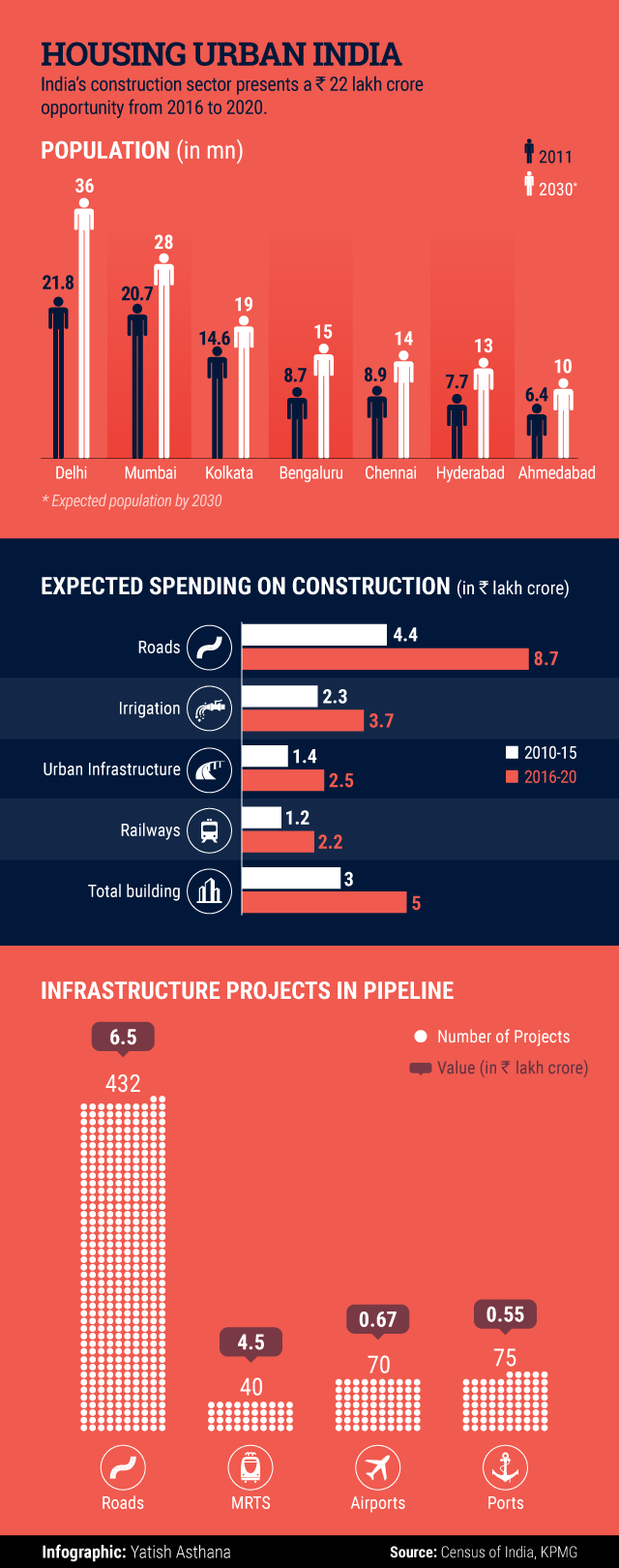

India will likely spend between Rs 5 trillion and Rs 7.5 trillion ($75-110 billion) in constructing houses and other infrastructure for its burgeoning numbers of city dwellers between 2016 and 2020, according to a report released jointly by KPMG and the National Real Estate Development Council (Naredco).

This will account for a third of the Rs 22 trillion the country is likely to spend on its construction sector by 2020, the report says. It adds that these mammoth spends present an opportunity for private investors to enter the construction market in general and the real estate market in particular.

The report also says that India’s goal to provide housing for all could translate into a $2 trillion (Rs 133 trillion) opportunity, in addition to the $1 trillion that is likely to be spent by 2030 for upgrading the country’s urban infrastructure. This also opens up a potential $45 billion opportunity for Real Estate Investment Trusts (REITs) in the country.

Another report released by real estate consultancy Cushman & Wakefield puts the potential REIT market around $43-54 billion. India allowed REITs in September 2014, but the country is unlikely to see its first REIT being registered before 2017.

To make REITs more investor friendly, the government exempted them from dividend distribution tax in this year’s budget. In June, capital markets regulator the Securities and Exchange Board of India sought to make REITs attractive by proposing to increase their investment threshold to 20% from the existing 10% in under-construction projects.

Like this report? Sign up for our daily newsletter to get our top reports.