Digital payment transactions, particularly via mobile wallets, picked up pace in December as a cash crunch after the government’s shock 8 November decision to withdraw high-value banknotes forced more people to look for alternatives.

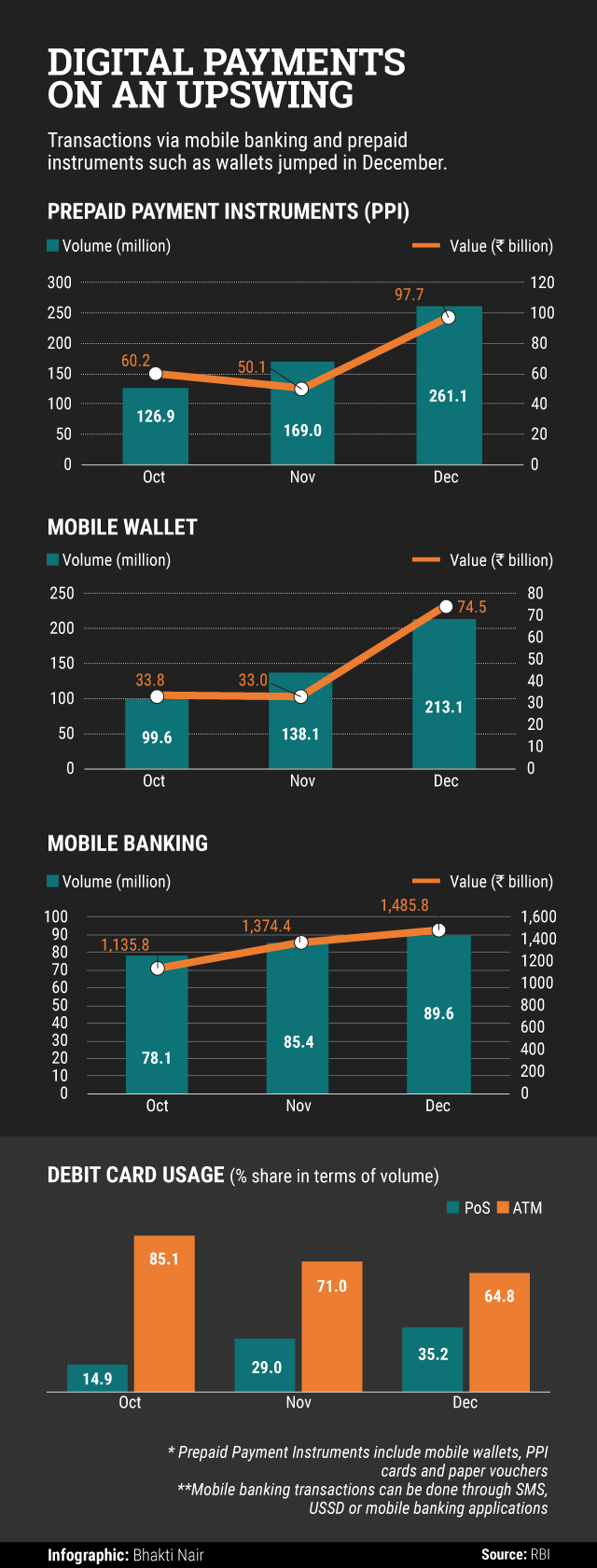

Reserve Bank of India’s data show the number of wallet transactions jumped 54% while the total value more than doubled in December from November, when the volume had risen but value had fallen.

The rapid growth in mobile wallets led to a similar increase in the overall prepaid payment instruments category, which also includes PPI cards and vouchers.

The RBI has given licences to 48 non-bank entities to operate prepaid payment instruments in the country. India’s top mobile wallets are Paytm, MobiKwik and FreeCharge, and they have claimed transactions surged after the note ban. The RBI didn’t release data for individual wallet companies.

Another indication that people are going digital is that the usage of debit cards at merchant outlets rose to 35% of the total value in December, up from 15% in October.

The data for December is the clearest indication yet of a change in people’s habits when it comes to making payments for goods and services via cashless means. Of course, it is too early to say whether this trend will sustain or if people will revert to old habits as and when the cash crunch eases.

Like this report? Sign up for our daily newsletter to get our top reports.