Merger and acquisition activity in India is set to increase in the next few years thanks to consolidation in some sectors and asset sales by debt-laden companies, according to a report by multinational law firm Baker McKenzie and economic advisory firm Oxford Economics.

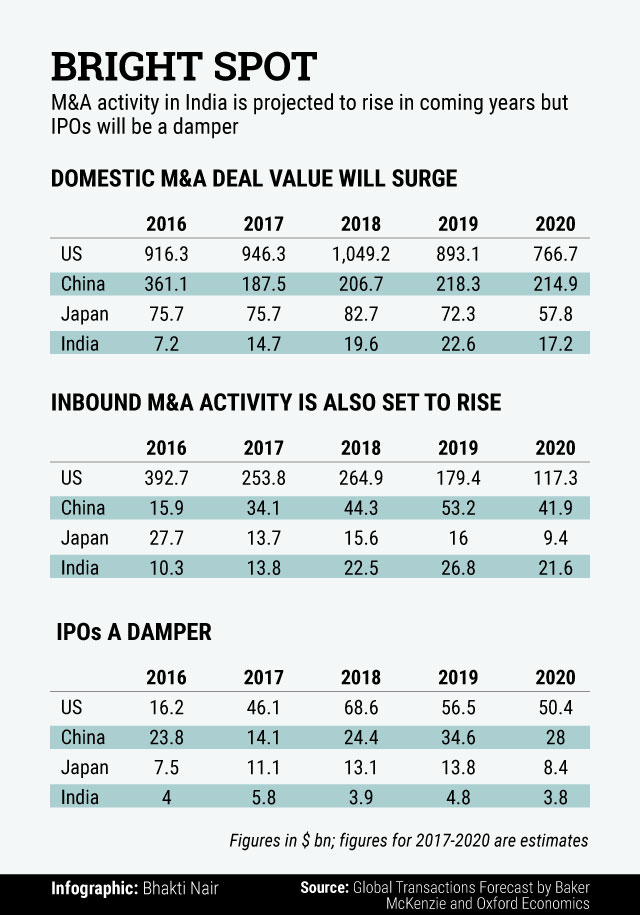

The report predicts that the M&A deal value in India will grow every year until 2019 before tapering off a tad.

Ashok Lalwani, global head of Baker McKenzie’s India practice, said in a statement, that sectors that are directly linked to the consumption story – financials, consumer, healthcare, Internet and real estate – will likely see good momentum for M&A deals.

Meanwhile, the domestic market for initial public offerings is estimated to touch $5.8 billion in 2017, before falling to $3.8 billion in 2020, the report said.

The report carries predictions regarding M&A and IPO activity for 37 countries. It considered nine variables such as trade-to-GDP ratio, stock prices and money supply-to-GDP ratio for its estimates.

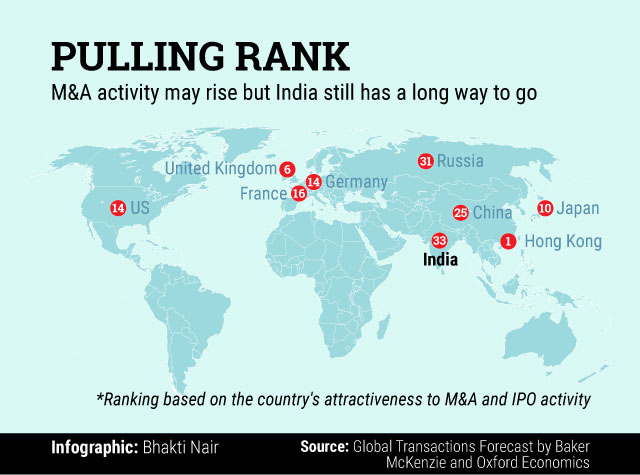

While M&A and IPO activity in India is projected to rise, the country still has a lot of ground to cover when it comes to becoming an attractive destination for deal-making.

The report ranks India at a lowly 33 in terms of the transaction attractiveness indicator, a ranking based on a country's attractiveness to M&A and IPO activity. The ranking takes into account 10 indicators, including the size of the stock market and the economy, political stability and sovereign credit risk.

Like this report? Sign up for our daily newsletter to get our top reports.