In the last Union Budget, finance minister Nirmala Sitharaman announced a proposal to establish a Social Stock Exchange (SSE) in India to be regulated by SEBI. Over the last few weeks there have been hectic consultations with SEBI on the formulation of the regulations.

As one of the investors in healthcare infrastructure, I had shared my thoughts on the framing of the regulations with respect to healthcare as a social sector and infrastructure. Here are the initial thoughts and issues that I see for regulations related to the Social Stock Exchange in India.

The need for regulation

Currently, over 50% of our population (about 500 million) is not covered by any institutional mechanism of healthcare financing. The trickle-down benefit they receive is 13 paise to a rupee that is budgeted for healthcare benefits. The balance is spent on administration and other ancillary costs of distribution. This bottom of pyramid (BoP) population has the least influence on the policies.

Moreover, the Ayushman Bharat model requires the private sector’s for-profit model to cross-subsidize healthcare delivery to the BoP population. This would adversely affect the profitability of these providers in the range of 30-45% depending on the type of hospitals. The return on investments would be impacted by 35-55%.

Hence, a new business model that would encourage investments in healthcare infrastructure to cater to such BoP population would need to be implemented. The SSE regulation needs to adequately address these different business models which would emerge in the future to raise capital for their social ventures.

Business model for delivery to BoP

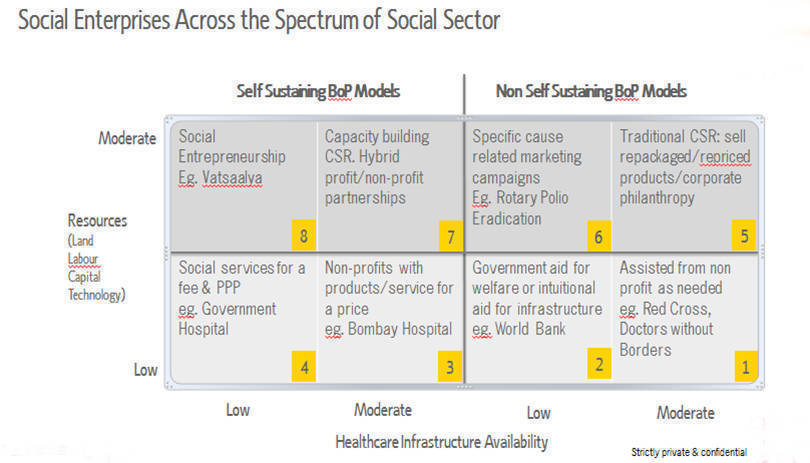

There are eight business models in the healthcare sector which are delivering social impact through delivery of healthcare infrastructure and services to the BoP. Some of these are purely donor, grant, CSR, aid-driven projects and one-off activities undertaken as a project.

These activities/projects (numbers 1, 2, 5 and 6 below) do not come under the purview of the regulation of the SSE as they are not vehicles that would raise capital for a sustainable activity by creation of a social venture. Therefore, models that are sustainable (No. 3, 4, 7 and 8) would need to be encouraged for floating different capital-raising instruments regulated by the SSE in India.

Regulatory framework for SSE for healthcare social ventures

The first SSEs have come into existence in the UK, US, Canada, and Singapore, complemented by some smaller SSEs in Brazil, South Africa and Kenya. The SSEs are new-age platforms designed to connect “businesses that deliver social and environmental value with investors seeking both a social and a financial return.

On the one hand, SSEs are tasked with protecting the social mission of listed issuers, which is directly tied to protecting the interests of the beneficiaries who are serviced by the issuer. On the other, SSEs are tasked with protecting investors who will only invest if they trust the market and the information they receive about issuers’ social and financial performance.

The key issue is whether fully fledged and regulated SSEs would essentially operate just like conventional stock exchanges by serving as market places for listing, trading, settlement and clearance of shares, bonds, and other financial instruments issued by or for social ventures, although in the context of highly specific listing and reporting requirements.

As we discuss the different aspects of regulating healthcare social ventures on the SSE, here are a few pointers for wider discussion and debate on regulatory framework to be proposed.

Listing criteria for social ventures

To protect the promise of social finance, an SSE must protect the interests of social ventures and investors. Therefore, the following entities would be qualified to list their issues on the SSE:

- Registered societies under the Societies Registration Act, 1860

- Section 8 companies under the Companies Act, 2013

- Public trusts under the Charitable and Religious Trust Act, 1920

- Social mutual funds (new regulations to be formulated by SEBI to regulate these mutual funds)

- Social REITs (additional regulations to be appended by SEBI under the REIT Act 2009)

- Social venture funds under the Alternative Investment Fund, 2012

Criteria for investor participation and regulation

There are two thoughts on who should be allowed or not allowed to participate as investors on the SSE. The well-known case of SKS Microfinance, which listed on the stock exchange and fell to the victims of financial investors’ greed for returns. In order to mitigate this, only qualified social impact investors and institutions should be permitted to participate on the SSE.

The other extreme is to allow all, including individuals from “finance-first” objective to “impact-first” objective spectrum, to freely participate as investors on the SSE. The current FDI and FII regulations can be appropriately modified to associate with the impact investors

Social impact definition, governance and audit for social ventures

The predefinition of social ventures which would be allowed to list in spite of their legal status defined above is through a smell test of the 4As of Social Ventures. This ensures that profit and cash flow maximization objective in the garb of a social venture in any form is not flouted. An additional social rating (like the Global Impact Investing Ratings System) though a rating agency and social impact audit through independent auditors can be made mandatory.

4As for Social Ventures

Availability – The extent to which customers are able to use a product or service. Distribution channels in BoP segments can be non-existent. Companies need to explore alternative methods of delivering their products and services.

Affordability – The degree to which goods and services are affordable to BoP consumers. Many low-income people survive on daily wages. Companies need to deliver offerings at a price that even the poorest consumers can afford.

Acceptability – The extent to which consumers are willing to consume, distribute or sell a product or service. Companies need to respond to specific national or regional, cultural or socioeconomic aspects, or local business practices.

Awareness – The degree to which customers are aware of a product or service. With many BoP customers largely inaccessible to conventional advertising media, building awareness can be a significant challenge for companies and they must explore alternative communication channels.

Social impact instruments for trading on SSE

Based on the global experience of various instruments being traded on SSEs, a phased manner of introducing various social impact investments must be explored. These include:

- Social private debt and securitised products

- Social equities

- Social REIT units

- Social mutual fund units

- Other engineered products for social ventures

Taxation on profits on SSE investments

The current taxation regulations can be tweaked to allow for both the social ventures and impact investors.

Disclosures, reporting and enforcement requirement on SSE

The norms for disclosures applicable to regular stock exchanges would apply to SSE. Besides, disclosures on the use of proceeds and social impact created would also be mandatory.

Extra-judicial and regulatory framework review

The current regulations for social sector trusts, societies and Section 8 companies prohibit the monetization of assets such as land and building. These would need to be adequately redrafted for these ventures going for listing on SSE.

Alignment of CSR funding into secondary SSE issues

The recent announcement of mandatory CSR investments by corporates would also need a definition if their participation into the secondary SSE issues is required.

How is the health?

As we set out to make the draft regulations for the SSE, the estimated spend on the BoP in India which could translate through the social ventures servicing this population is estimated to be around $1 trillion by 2025. The expected healthcare spend is expected to be around $275-350 billion. The addressable social ventures that would qualify to be listed on the SSE would potentially deliver an annual turnover to be around $5 billion on a conservative basis.

Kapil Khandelwal is managing partner at Toro Finserve LLP (sponsor to India Healthcare Opportunities Fund) and director at EquNev Capital Pvt. Ltd.