The outperformance of the BSE small & mid cap indices vis-à-vis the broader market has tailed-off. Given that high inflation, high interest rates and global uncertainty have historically compressed Indian small & mid cap stocks' outperformance, we don’t expect small & mid cap stocks to

outperform in the rest of FY11.

Small & mid cap stocks’ outperformance trending lower

The BSE small & mid cap indices’ outperformance vis-à-vis the broader market has fallen from plus-15% in Q1 FY10 to sub-5% in Q1 FY11. This raises two questions: what causes small and mid cap indices’ to underperform and will these indices under or out-perform going forward?

Drivers of small-mid cap underperformance

Historical analysis of small & mid cap companies’ outperformance vis-à-vis the broader market suggests the existence of an inverse correlation with domestic inflation, policy

rates and global risk aversion (see Table 1).

What this implies is that higher inflation, rising domestic policy rates and lower global risk appetite pull down small & mid cap stocks’ outperformance vis-à-vis the broader market. This in fact is a perfect characterisation of the current macroeconomic environment with high inflation necessitating policy rate hikes domestically and the global macro outlook remaining uncertain.

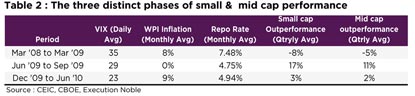

Moreover, the past ten quarters can be divided into three distinct phases as detailed in

the table below.

The first phase spanning Q4FY08-Q4FY09 was characterized by small & mid cap stocks’ underperformance vis-à-vis the broader market as global risk aversion, domestic inflation as well as policy rates remained heightened.

The next brief phase spanning Q1FY10-Q2FY10 witnessed high outperformance by small & mid cap companies as inflation and policy rates eased significantly whilst risk appetite improved marginally.

The third phase spanning Q3 FY10-Q1FY11 saw the extent of small & mid cap stocks’ outperformance come down meaningfully as the policy rate cycle turned upwards in response to high positive inflation whilst uncertainties in the West prevented global risk aversion from dipping below its long term average reading of 21.

Investment Implications

Whilst global risk appetite is difficult to forecast, small & mid cap stocks will face headwinds going forward on account of high inflation and higher cost of bank credit. As highlighted earlier, high inflation in India (north of 5%) is likely to persist until the end of FY11. Moreover, high inflation hammers returns for the small & mid cap indices more profoundly than it does for the rest of the market.

Secondly, rising policy rates will translate into higher cost of bank credit – a

development which will disproportionately impact small & mid cap companies given their higher dependence on bank-based sources of finance and lower bargaining power vis-à-vis their lenders.

In light of the above, it is unlikely that Indian small and mid cap stocks will exhibit outperformance in the rest of FY11.