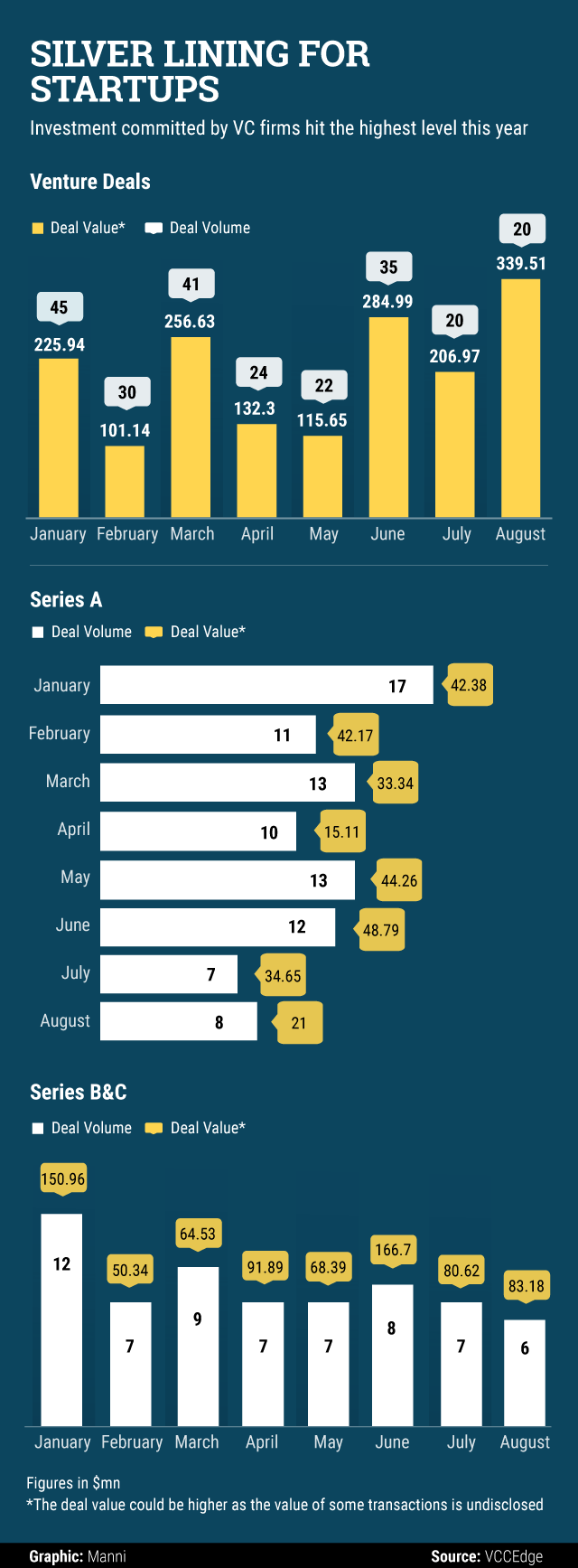

First, the good news. The number of startups that received venture capital (VC) funding has stayed put in August and July and the quantum of VC money flow in India has risen to the highest level in a single month this year.

Although the overall money absorbed by Indian startups was buoyed due to messaging venture Hike’s Series D round of funding, stemming of the decline in number of VC deals—Series A and beyond—itself suggests stability is returning after deal-making peaked in 2015. This means there is a silver lining for startups looking to raise funds for their next phase of growth.

"Stability in a trend is a good sign of a reversal too. The quality of startups and entrepreneurs is consistently improving... A pickup should be visible in 12 months on larger numbers being venture funded," said Sunil Goyal, founder and CEO of YourNest, which essentially chases pre-Series A deals.

The deal volume at the Series A level improved slightly, after hitting its lowest in years in July, according to News Corp VCCEdge, the data research platform of VCCircle.

Series A venture capital deal-making is crucial for startups as it marks the first institutional round of funding and brings a larger stash of capital compared to angel or seed funding rounds. It also sets the stage for bankrolling bigger expansion plan for a startup.

The bad news is that at just 20 VC deals, August was still the slowest month in over a year. Take out Hike’s $175 million funding and overall VC money flow also looks puny again.

The pain at the mid-stage funding level deepened as deal volume declined again in August.

More hope

Angel and seed funding, too, had sputtered after summer set in and money flow started drying out. But, after declining for three straight months, the number of startups receiving their first funding cheque rose in August.

Coupled with the pause in sliding VC deals, the number of startups getting angel or VC funding rose last month, albeit marginally, to 76 from 72.

A clearer picture would emerge as data for September are compiled.

Like this report? Sign up for our daily newsletter to get our top reports.