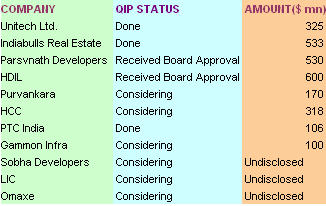

Three years after it found its way to Indian capital markets, qualified institutional placement (QIP) is becoming the preferred route for Indian corporates to raise capital. Dozens of Indian real estate companies have announced their QIPs while a few like Unitech and Indiabulls Real Estate have successfully raised a total of $1 billion from foreign investors. Many other corporates like LIC Housing Finance and Hindustan Construction Company are also doing QIPs. What has made QIP's hot suddenly?

Three years after it found its way to Indian capital markets, qualified institutional placement (QIP) is becoming the preferred route for Indian corporates to raise capital. Dozens of Indian real estate companies have announced their QIPs while a few like Unitech and Indiabulls Real Estate have successfully raised a total of $1 billion from foreign investors. Many other corporates like LIC Housing Finance and Hindustan Construction Company are also doing QIPs. What has made QIP's hot suddenly?

\n

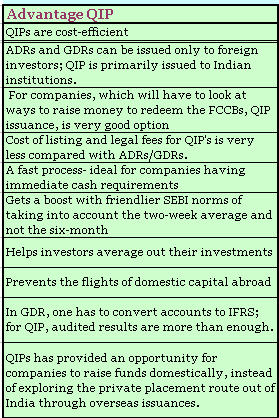

One is the current state of the markets where most shares are trading at 50% or even 100% below their highs. Add to that the investor-friendlier QIP regime effected by SEBI last year. Currently, the floor price for a QIP issue is based on just a two-week average of the stock price, while earlier it had to be done at higher of the average of the weekly high and lower of the closing prices of the shares during the two weeks or six months preceding the relevant date (which has also been redefined now to the date of board meeting authorising QIP).

\n

"There is a sudden rush for the QIPs now, because there is a demand for Indian papers from overseas institutional buyers and there is a money requirement in the India companies, especially in real estate.

\n

There is also a belief that there is a huge upside of stocks left to ride on,” said Sanjay Bansal, Managing Director, Ambit Corporate Finance.

\n

All told, investors are getting shares via QIP at a much lower price than they could get them a year earlier. For instance, Unitech QIP on April 17 was placed at Rs 38.50 per share and Wednesday’s closing price was Rs 77.10. Investors are already 2X in one month. Unitech QIP raised $325 million from investors like Prudential, Och-Ziff, Orient Global, Sandstone Capital and HSBC. The real estate biggie raised resources to retire its huge debt and strengthen its balance sheet.

\n

Last week, Indiabulls Real Estate entered the market with its $600 million QIP. The issue was subscribed on day one by foreign investors like Fidelity, HSBC, TPG Capital and Moor Capital, who together invested $553 million.

\n

Now companies like Puravankara Projects, HDIL, Parsvanath Developers and Shobha Developers are following the path of Unitech and Indiabulls, while a host of other real estate companies, who are laden with high cost debt are also contemplating this route to raise capital. Also non developers like Hindustan Construction Company (HCC) plan to raise up to Rs 1,500 crore through QIP, while LIC Housing Finance board is meeting on June 1 to consider QIP or a share issue on preferential basis.

\n

Quicker, Informed And More Secure

\n

“Going the QIP route works for the institutions who have liquidity at their disposal. Instead of doing a market deal, they are able to do a transaction directly with the company. This involves a formal process of interaction with the company and investors are privy to more information. So it is a more informed decision as far as investors are concerned," said Abhishek Goenka, Partner, Real Estate and IT Practise, BMR Advisors. Also with SEBI relaxing the QIP norms, the investors are getting these companies at a decent valuation.

Echoes Rajiv Sahni, Partner, E&Y, who believes that both the timing and valuations are just apt for the investors to indulge in QIPs now. “Institutional investors can now take significant positions as prescribed by SEBI’s new norms. The whole process can be completed very quickly. The market capitalisation being where they are - a 25% off the peak valuations a year ago, it is just good for the investors.”

\n

Also from a private equity real estate investor point of view, it makes sense as it gives them exposure at the entity level and does not restrict them to a partnership in an individual project. “QIP money comes into a company at the entity level. The advantage from the PE investor perspective is that with the valuations being where they are, they can capture the upside in the companies by coming in at these valuations and not be exposed to the vagaries of individual projects,” said Sahni.

\n

Greater Investor Appetite

\n

Another contributing factor is that the investor appetite for Indian domestic paper has gone up. HSBC, which bought shares worth $300 million in Indiabulls Real Estate, had also bought shares in Unitech’s QIP. The British bank had also participated in the fund raising process of DLF Ltd, India's largest real estate company which sold a 9.9% stake to raise Rs 3860 crore.

\n

Fidelity invested in both DLF and Indiabulls Real Estate. The others like Prudential, Och-Ziff, Orient Global, Sandstone Capital, Euro Pacific Growth Fund and Copthall Mauritius bought Indian papers in the last few days. Also there is a lot of dry powder available with real estate focused funds who now find it opportunistic to invest. “There is a lot of money available only for investment in real estate as a lot of investors came up with real estate focused funds. Such funds can’t be used for investment in other sectors in any case,” added Sahni of E&Y.

\n

There are a host of real estate funds which had their closing and are sitting on enough dry power. IL&FS Investment Managers Ltd has raised $895 million for a new realty fund in December last year. Sun Apollo Real estate, Kotak realty fund and Red Fort Capital are also few of the funds which had their close recently.

\n

QIPs are the flavour of the season. But how long the party lasts purely depends on the overseas investor interest.