2010 has been a challenging fund-raising for the private equity world as it comes after a period of poor deal activity. Lack of deal flow due to poor valuations in 2009 locked up a lot of capital leaving very little for fresh investments. About 22 funds, (14- India focussed and 8 Asia focussed including India) secured a total of $7822.2 million in capital commitments in 2009 , a far cry from $44,535 million secured by 45 funds (33-Indian and 14 Asia focussed including India) the funds that closed the year before, according to VCCedge. While many LPs began seeing returns (by the end of 2009) but they still did not have substantial capital for new relationships. The economic slowdown also brought home lessons on the risk of illiquidity, which raises the bar for new commitments. VCCircle spots some trends in fund-raising in 2010 some of which could well hold good for the next calendar year as well.

2010 has been a challenging fund-raising for the private equity world as it comes after a period of poor deal activity. Lack of deal flow due to poor valuations in 2009 locked up a lot of capital leaving very little for fresh investments. About 22 funds, (14- India focussed and 8 Asia focussed including India) secured a total of $7822.2 million in capital commitments in 2009 , a far cry from $44,535 million secured by 45 funds (33-Indian and 14 Asia focussed including India) the funds that closed the year before, according to VCCedge. While many LPs began seeing returns (by the end of 2009) but they still did not have substantial capital for new relationships. The economic slowdown also brought home lessons on the risk of illiquidity, which raises the bar for new commitments. VCCircle spots some trends in fund-raising in 2010 some of which could well hold good for the next calendar year as well.

No need to sell the India story now: Private equity investors go after GDP. Indian real GDP growth continues to be exceptionally strong. The economy has grown by an average of 8.25% since 2003. The case for investing in India is a strong one and private equity fund managers believe that there is no need to sell the India story anymore to institutional investors. “India as an asset class is well–established. You don’t need to sell the India story now,” said Nainesh Jaisingh, MD, Standard Chartered Private Equity. Mukul Gulati, MD, Zephyr Peacock India Management, too echoes the same sentiment, saying, the interest and appetite of institutional investors is here to stay. This is no more being seen as a hedge against the losses in the developed world but as a great investment opportunity riding on decreasing dependence on the US and Europe, increasing intra-Asian trade, urbanization and the emergence of a sizeable middle class.

Hiring a placement agent pays: Successful fund-raises this year have been on the back of placement agents. “Placement agents are critical to fundraising for emerging markets PE funds, more so than they are for US or Western European funds,” says Kevin Johnson, MD of Liberty Global Partners, a firm providing placement and consulting services for private equity firms investing in emerging markets. This is true of a host of funds, which had a successful run at fund-raising. IndiaValue Fund, Avigo Capital and Renuka Ramnath’s Multiples had star placement agent, Guy Eugene, who heads Legacy Finance Ltd, a Swiss placement firm. While Ajay Relan’s CX Partners hired UBS Capital as a placement agent, IL&FS India Reality Fund 2 (IIRF-2), which closed at $895 million (Rs 4,300 crore), hired Presidio Partners, a US based placement agent. According to Johnson, “placement agents provide the context that helps LPs reach sufficient comfort level to give serious consideration to a manager from an unfamiliar market”. He adds that it also brings about efficiency as a majority of LPs in the US and Europe still don’t invest in emerging markets. So a GP can waste a lot of time without a good placement agent who knows which LPs have appetite for a new relationship.

Funds taking longer to close: Raising a fund today takes much longer. Fund managers are seen to be prepared for a more protracted process than it was in the past. “The due diligence is taking much longer,” says Jayant Sinha of Pravi Capital. This can be seen as there are a host of funds who have announced their fund raising plans and have not achieved a first close till now.

Interim closes good for fundraising: With the fundraising process taking longer, it is being seen that LPs are parting commitments in tranches and that PE fund managers are making various closes before concluding the final one. According to Gulati of Zephyr Peacock, this “helps the fund stay relevant as it can warehouse the initial commitments to make investments”. Also, LPs prefer to commit after a fund has held first close. “There’s more light on the strategy and performance of the fund”, says Jayant Sinha, Pravi Capital, which is currently raising a $200 million fund. This particularly applies to first-time funds. A few LPs prefer to invest only in subsequent closes as they draw comfort in the fact that there have been “first set of LPs who have done detailed due diligence”. For LPs who are investing in funds that are known to them, they can come in as early as prior to a first close, as it is a bit easier to negotiate terms and conditions.

Fund terms and conditions gain prominence: Fund terms and conditions have been a prominent issue for private equity investors during the past year as LPs seek a greater say. According to an LP, having an on-the-ground presence here, who did not wish to be quoted, said, “while fund terms have some influence, no amount of negotiating helps if the fund under-performs. So, team quality is most important.” In the past year, LPs have expressed serious concerns about proper alignment of interests between the GPs and the LPs. The level and structure of management fee and the structure of carried interest to be altered are the most frequent ones. LPs have also showed their prference for the funds with skin in the game.

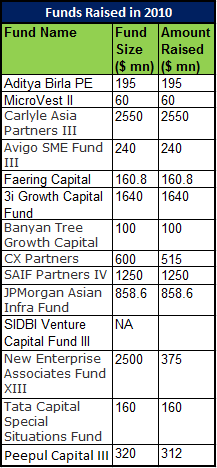

Domestic Fundraising Sees Huge Traction: A significant amount of money was tapped domestically by private equity fund managers. “There is a lot of awareness about domestic fund raising now. It is being seen as a significant pool of capital,” says Bharat Banka, MD, Aditya Birla PE, the private equity arm of Aditya Birla Group, which made the first close at Rs 675 crore fully from domestic money. According to Preqin, a London-based research house that tracks this sector, banks and investment banks make up 41% of India’s LP community, representing the largest PE investor grouping in India. Apart from SBI, a significant player is PNB which has about $100 million allocated to the asset class.

Backing a team than an individual: Increasingly, LPs have been vocal about backing teams than a star performer and prefer a diverse mix of strong professionals with their own decision-making capabilities. According to an LP, who did not wish to be quoted, “star players who show commitment to build a team in the long run may also get backing. But the commitment is to be real not just amounting to recruiting a large team that just is a bunch of yes-men”. LPs have also been very keen on having a PE team which has a fair mix of operating and investing professionals with proper incentivization accruing to both of them. Praneet Singh, MD, Siguler Guff India Advisors Ltd, says, “the private equity business has two distinct, complementary yet opposing parts to it – Finance and Operations. And, the good private equity teams in business today are able to leverage their deep understanding and skillsets on both these dimensions for success.” Betting on a good team is one of the most crucial things and “doing an attribution analysis of one's track record is crucial, and can sometimes be quite challenging”, adds Menka Sajnani, VP, Auda Investment Advisors.