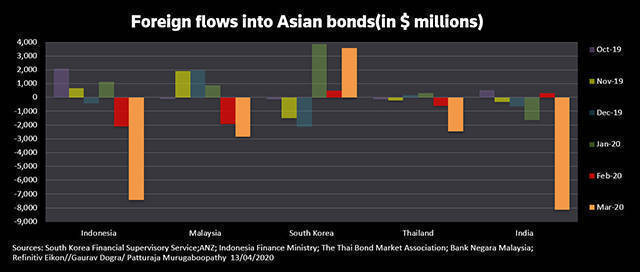

Asian bonds recorded their biggest foreign outflows in at least seven years in March, as investors turned risk averse on concerns over the coronavirus outbreak and chased safer assets such as the U.S. dollar and money market instruments.

Foreigners sold a net $17.28 billion worth of regional bonds last month, the highest since at least January 2013, according to data from regional banks and bond market associations in Indonesia, Malaysia, Thailand, South Korea and India.

Indian debt saw the biggest outflows, worth $8.13 billion in March and the highest since at least January 2002, the data showed.

Indonesian bonds posted $7.44 billion worth of outflows, the most in at least 10 years, while Malaysian and Thai bonds saw outflows worth $ 2.85 billion and $2.45 billion, respectively.

South Korean bonds, however, saw a third straight month of inflows, attracting $3.58 billion.

Analysts said the outflows were driven by the rapid spread of the coronavirus and fears it would hit Asia's economic growth with factories shuttered and services disrupted across the region to curb the outbreak.

India and other South Asian countries are likely to record their worst growth performance in four decades this year due to the coronavirus outbreak, the World Bank said on Sunday.

India will extend a 21-day lockdown due to end Tuesday, according to a state chief minister with knowledge of discussions among top officials, although the federal government has yet to make an announcement.

"With the level of uncertainty still high, we expect portfolio flows to stay volatile (in the region), said Khoon Goh, head of Asia research at ANZ Banking Group, in a report."