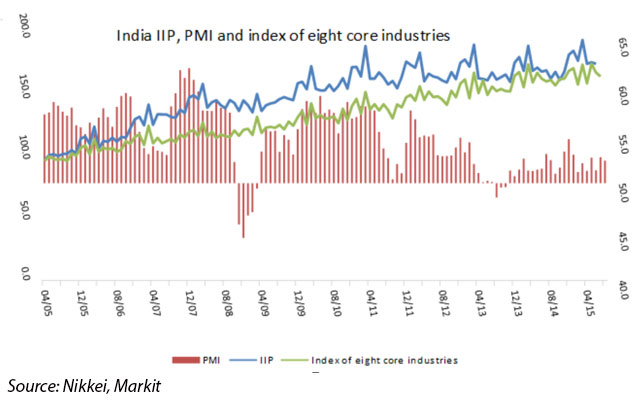

Indian factory activity lost some momentum growing at a slower pace than last month with the Nikkei Manufacturing Purchasing Managers Index (PMI) coming at 52.3 in August against a six-month high of 52.7 in July.

Nikkei Manufacturing PMI, previously known as HSBC manufacturing PMI and compiled monthly by financial information services firm Markit, measures economic health of a sector based on surveys of private sector companies. A reading of above 50 on the index denotes expansion. The manufacturing output in the country expanded for the 22nd successive month.

Softer increases in output, new orders and stocks of purchases contributed to downward movement of headline index with employment levels stagnating. While post production inventories fell to sharpest pace since April 2005, input costs decreased for first time in six months with firms lowering their selling prices.

Although PMI shows some promise, data for core industries released on Monday was disappointing with growth falling to 1.1 per cent for July from 3 per cent in June. With GDP figures showing a slow first quarter and inflation well below the RBI level, RBI governor Rajan may be forced to cut rates in the September 29 review.