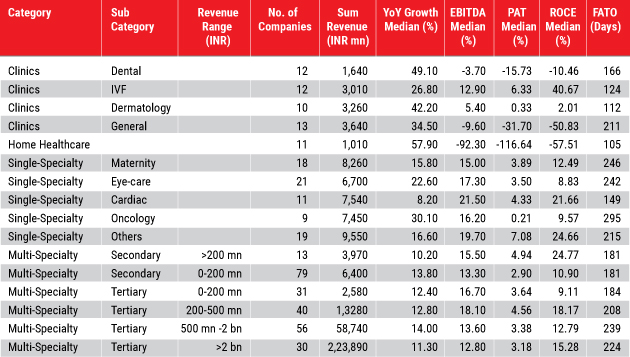

Eye-care chains, in vitro fertilisation (IVF) and oncology companies beat other healthcare services provider segments such as dental care and cardiology to record a healthy growth in financials in FY2015-16, according to a News Corp VCCEdge report.

The three segments have grown over 20% per annum in revenues and over 10% in earnings before interest, tax, depreciation and amortisation (EBITDA), revealed the report titled ‘An Insight into Indian Healthcare Services’. A total of 385 companies were analysed based on the financials for FY2015-16.

The eye-care sector recorded a median revenue growth of 21% and median EBITDA of 17% in the financial year ended 31 March 2016. In this segment, 22 companies, including Dr Agarwal's Eye Hospital and Centre For Sight were analysed. Other key players such as Sequoia Capital-backed Vasan Eye Care and Arvind Eye Hospitals could not be considered for the analysis as their financials are not available.

The IVF industry registered a median revenue growth of 26.8% and median EBITDA of 12.9% in FY2015-16. In this space, 12 entities were analysed that had a cumulative turnover of close to Rs 300 crore.

Major players in the IVF segment include Nova Medical Centers, which is backed by Goldman Sachs, New Enterprise Associates (NEA) and GTI Capital; Bourn Hall India, which is backed by private equity firm TVM Capital MENA; and Oasis Centre for Reproductive Medicine, which is backed by India Life Sciences Fund II.

Oncology hospital chains clocked median revenue growth of 30% during the period and median EBITDA was 16%. In this segment, nine companies were analysed which accounted for over Rs 745 crore.

Bengaluru-based Healthcare Global Enterprises (HCG)—which was listed on the stock exchanges last year—is the largest player in the market with revenue of Rs 585 crore. The company is backed by investors such as PremjiInvest, the investment platform of software services firm Wipro, and Sabre Partners.

Other healthcare services segments

Mother- and child-care, dental-care and home healthcare sectors have also shown healthy growth but either their revenue or EBITDA has missed the mark.

Maternity and child-care recorded a median revenue growth of 16% in FY2015-16 and median EBITDA was 13%. The report considered 19 companies in the space which accounted for over Rs 1,000 crore in revenues.

Among the maternity and child care hospitals that were analysed, Rainbow Healthcare, which is backed by Abraaj Group and CDC Group, has been the largest with a turnover of close to Rs 250 crore in FY2015-16. The other major players in the space include Cloudnine, which is backed by True North, Sequoia Capital and Matrix Partners; and Motherhood, which is controlled by TPG Growth.

In the dental space, while the 12 companies that were analysed had a stunning median growth of 49% in FY2015-16, they had poor median EBITDA of -4%. The factors that led to negative EBITDA are high marketing expenses and opening of new outlets which are yet to break even, the report noted.

Investor-backed dental firms include Sabka Dentist and Axiss Dental. In a sign of consolidation, Clove Dental and Dentys, which was backed by venture capital firm Helion Ventures, merged early this year.

In the home healthcare space, the 11 entities that were analysed had a cumulative turnover of close to Rs 100 crore with a median revenue growth of 58% and a negative median EBITDA of -92%.

Healthvista India Pvt. Ltd, which operates under the brand name Portea, is the largest player in this segment with Rs 42 crore in revenue in FY2015-16, marking a growth of 150% over the previous year. Medwell Ventures, which is backed by Mahindra Partners and Eight Roads Ventures; and Health Care at Home, which is backed by Quadria Capital, are other major players in the space.

The report has a detailed analysis of the segments mentioned above along with their future outlook. It also has in-depth study on other segments of healthcare services such as skin-care clinics, cardiology as well as secondary- and tertiary-care hospitals.

Please find the full report below.