Alternate Investment Market (AIM) listed Evolvence India Holdings Plc (EIH) has announced its results for the year 2008, with net asset value (NAV) per share falling by 38% to $0.713 as compared to last years $1.158. The net assets were valued at $46.3 million, a significant fall from last years $75.2 million. The fund has made a loss of $27 million for the year 2008. The firms stock price was down by nearly 10% to 48 pence at close of trading on 16 June.

Alternate Investment Market (AIM) listed Evolvence India Holdings Plc (EIH) has announced its results for the year 2008, with net asset value (NAV) per share falling by 38% to $0.713 as compared to last years $1.158. The net assets were valued at $46.3 million, a significant fall from last years $75.2 million. The fund has made a loss of $27 million for the year 2008. The firms stock price was down by nearly 10% to 48 pence at close of trading on 16 June.

The fall in EIH assets have come as India's Bombay Stock Exchange fell by about 61.5% in value in the calendar year 2008. But the index has bounced back by more than 57% in value since the beginning of this year, which is sure to have impacted the portfolio of EIH.

In another development, Mehdi Dazi has resigned as a non-executive director of EIH, to concentrate on his other business interests. EIH has appointed Anderson Whamond, who was till recently a director of AIM listed investment management group Charlemagne Capital Limited, as

an independent non-executive director . EIH's management agreement with Evolvence India Advisers Inc is also expiring by September-end, after which the fund will announce a new adviser.

\n

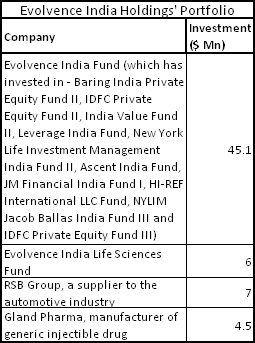

EIH was listed on AIM in March 2007 raising $65 million from investors. The fund has invested $45.1 million of the net proceeds of its public offering to Evolvence India Fund (EIF), a fund of funds which also makes co-investments. Another $6 million is invested in Evolvence India Life Sciences Fund (EILSF) and remaining $14 million in direct/structured investments.

\n

Write Downs and Defaults

\n

The London-listed firm has made unrealised write downs its investments in EIF and EILSF, and has also been hit a by loan default. Of the $45.1 million committed to EIF, a little more than $36 million has been invested, which has been fair valued at $26.084 million. The $1.92 million invested in EILSF has been fair valued at $1.6 million.

\n

The company also made a $2.5 million loan to Katra Holding, which is under default and EIH has initiated strong measures for its recovery.

\n

Exits

\n

EIF, which has a corpus of $250 million, has invested in 10 private equity funds and has made several co-investments. It has a portfolio of 110 companies directly and indirectly. This portfolio has had fifteen successful full exits and five partial exits, realising a multiple of above 2.5 times on the invested cost. The fund exited its shareholding in Centurion Bank of Punjab, one of its co-investments, at a gross IRR of 54% in 2008.

\n

Evolvence India Holdings also gave an unsecured loan of $7.8 million to Aqar Holdings at a rate of 10%, which was completely repaid during the year.