Mensa Brands Technologies Pvt. Ltd, which owns and operates a host of direct-to-consumer companies, on Thursday said it has raised $40 million (around Rs 330 crore) from growth-stage debt financing platform EvolutionX Debt Capital.

Mensa Brands has raised the capital through a combination of debt facility and convertible investment.

The brands roll-firm, which acquires small brands and supports their expansion through various processes, including marketing, finance, and distribution, will be deploying the fresh proceeds to invest in brand building. It will only invest the sum to improve capabilities across technology, operations and marketing.

“Mensa has proven its execution capabilities with the successful acquisition of multiple brands, and we look forward to supporting the company’s journey as it continues to grow its brands both in domestic and international markets,” said Rahul Shah, partner at EvolutionX Debt Capital.

“With this investment, we continue our strategy to invest in category-leading growth stage tech companies in Asia,” Shah added.

Prior to this, Mensa Brands, in November 2021, raised $135 million at a valuation of more than $1 billion, making it one of the fastest Indian startups to reach unicorn status. A unicorn is a privately held company with a valuation of $1 billion or more.

To date, Mensa Brands has raised $200 million in equity from several investors including, Accel Partners, Falcon Edge Capital, Norwest Venture Partners, Prosus Ventures and Tiger Global Management. Separately, it has also secured debt financing from Alteria Capital, InnoVen Capital, Stride Ventures, and TradeCred.

The firm owns and operates several consumer brands including smart wearables and audio devices company Pebble, peanut butter seller MyFitness, men’s lifestyle and apparel retailer Dennis Lingo and perfume and personal care brand Villain.

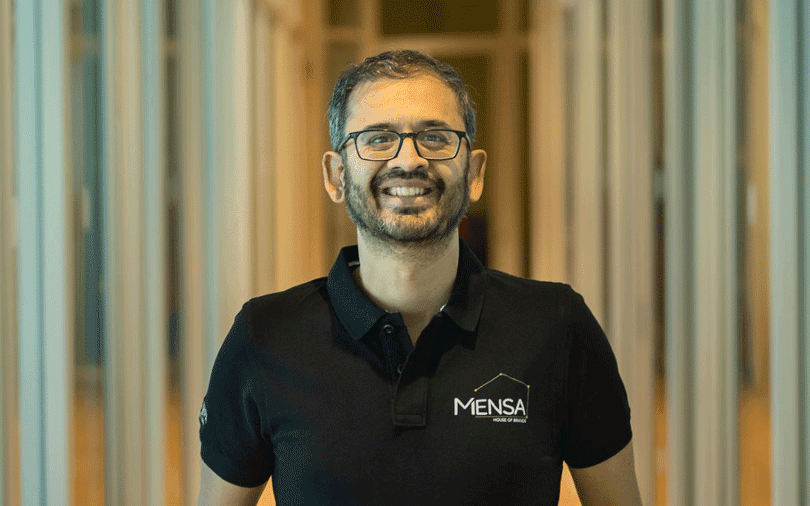

“In the last two years, we have profitably scaled more than 20 brands across beauty, FMCG, fashion, home and consumer electronics,” said Ananth Narayanan, founder and chief executive officer of Mensa Brands.

In the past, EvolutionX Debt Capital has invested $24.4 million in debt in lendingtech firm Lendingkart, $40 million in business-to-business marketplace Udaan, and an undisclosed sum in online pharmacy platform PharmEasy’s parent company API Holdings Ltd.