Everstone Capital-backed medical technology company Integris Health Pvt Ltd has roped in former group chief financial officer of Medanta to strengthened its top rung.

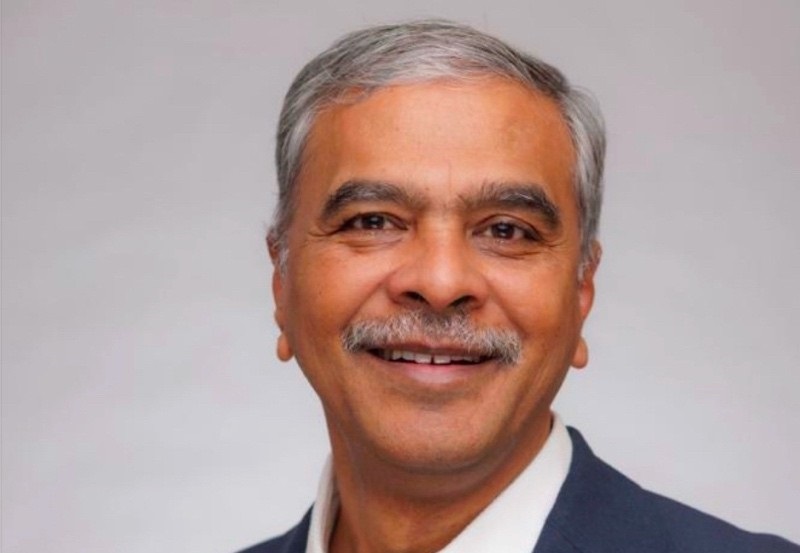

Integris Health Pvt Ltd, which manufactures cardiac stents and cardiovascular medical devices under the Translumina Therapeutics brand, has onboarded Sanjeev Kumar as group CFO, effective February 3. Kumar will be based in New Delhi and report to group CEO Probir Das.

“Sanjeev's track record in leading finance functions for large businesses, combined with his expertise in navigating successful IPOs, makes him an invaluable addition," said Das.

Kumar brings over three decades of experience in finance, having held leadership roles at Bharti Airtel and InterGlobe Enterprises. Most recently, he served as the group CFO at Medanta – The Medicity, where he led India's largest IPO in the hospital sector.

He is an alumnus of Shri Ram College of Commerce, and is also a chartered accountant and a company secretary. He recently completed Harvard’s Advanced Management Programme.

Integris has a presence across India, South-East Asia, Europe, the Middle East, and Latin America.

VCCircle reported last month that Integris raised Rs 375 crore (around $45 million) from a mix of domestic and international investors. This was a primary transaction as part of its pre-IPO funding in a round led by PE firm India SME Investments and ace stock market investor Mukul Agarwal, along with contributions from GreenGen Capital, Mission Street India, CJ Shah Group, and other Singapore-based investors and family offices.

It operates in four segments within cardiovascular devices and in-vitro diagnostics: clinical diagnostics, scientific lab solutions, cardiovascular devices, and vascular access therapies.

Everstone Capital is the private equity arm of Everstone Group, a global firm with assets under management of over $8 billion. The PE firm is focused on mid-market, control growth and cross- border opportunities across technology, healthcare, financial services, and industrials.