Eurozone leaders were able to come to an agreement with Greece to negotiate terms on the third bailout to keep it within the bounds of the Eurozone. The marathon talks at the emergency meeting called by Eurozone leaders reached fruition on Monday when Athens accepted a bailout of $95.78 billion or 86 billion euros.

Greek prime minister Alexis Tsipras who had taken a hard stand earlier and asked the country to vote no to the terms of bailout caved to the demands of Germany and its other creditors to implement a plan with highest level of economic supervision by its lenders.

"Eurogroup will work with the institutions to swiftly take forward the negotiations. Finance ministers will also as a matter of urgency discuss how to help Greece meet her financial needs in the short term, so-called bridge-financing," said Donald Tusk, president of the European Council after the meeting.

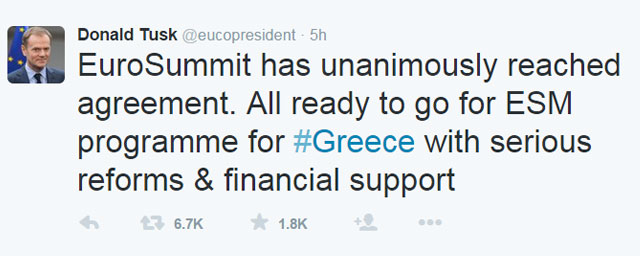

Tusk had previously tweeted about the success of the talks and reaching agreement on ESM programme.

Under the new plan, the debt burdened nation is expected to receive its third bailout in the last half a decade via a programme funded by European Stability Mechanism and the International Monetary Fund (IMF).

The new plan will require the country to pass new reform laws on taxation and pensions by Wednesday and introduce further austerity measures. The country will also have to initiate reform process on labour market liberalisation and reinforcing the financial sector.

One of the harshest measures which Greece agreed to was the sequestration of Greek assets for 50 billion euros to pay the debt that country owes to IMF and Eurozone lenders. The programme will also involve privatisation and bank recapitalisation for the nation which had capped withdrawal limits and shut the markets to avoid a run on the bank situation.

A job half done

While Tsipras agreed to allowing Germany and its creditors to dictate terms, it will be an uphill task for the Syriza party head to convince his people to accept the terms. The Greek prime minister had a glimmer of hope as he bargained hard to remove the "time out clause" proposed by Germany from the agreement which offered the country a time out from Eurozone if it failed to meet the terms of the bailout.

While the Eurozone members were able to subdue fears of a Grexit, it will take a lot of convincing on part of Tsipras for his party members to accept the terms of the agreement. Reuters reported that even before the final terms were known, his labour minister went on state television to denounce the terms. Labour Minister Panos Skourletis said the terms were unviable and would lead to new elections this year.

The way forward

While the country with a debt to GDP ratio of 177 per cent and an unemployment rate of 26 per cent was able to avoid a full blown crisis and eventually an exit by accepting the terms of bailout for now, it may fall prey to political instability as leftists call for fresh elections.

Also Eurozone has set a dangerous precedent for its other members by allowing the country another bailout. While there is no guarantee that despite the draconian measures they will be able to save the country from exiting the union, other Eurozone countries may ask for more funds given that they have put cash in one.

For now the markets are rejoicing the decision; the UK and German stock exchanges are up for now as they wait for Greece to pass required legislations.

The news is also a comforting one for the global economy which was preparing itself for another turmoil. While the risks from Greece have staved off for now, China still remains a risky proposition. With Greece out of the way the focus will shift on US Federal reserve which is expected to hike its policy rate.

Indian markets also rejoiced the new bailout plan as the benchmark stock index Sensex surged 300 points and Nifty settled above 8,450 after the announcement. Though the country was isolated from a full impact of the Greece incident and more dependent on domestic developments, a normalisation in Europe will help it promote its languishing export sector.