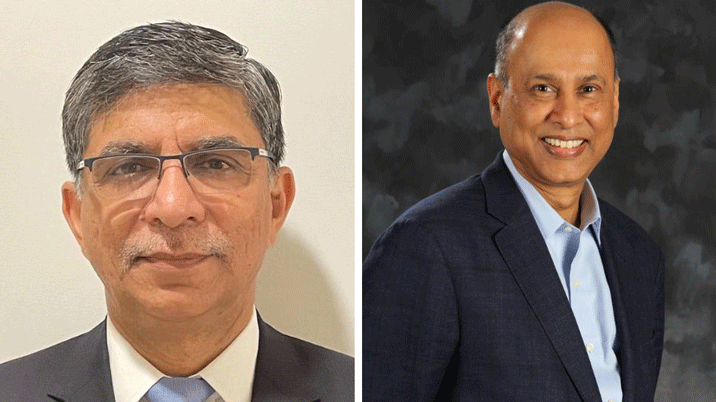

Early-stage venture capital firm Unitus Ventures, on Tuesday announced appointments of Sanjiv Rangrass as venture partner and Raj Nooyi as venture adviser.

In his new role, Rangrass will lead the firm’s investment strategy in the climate sector, which is Unitus’ upcoming fund’s focus area. The next fund is expected to be launched in early 2023.

Rangrass has had a career of four decades at ITC Ltd, where he joined as a trainee and eventually became the chief executive officer (CEO) of the company’s agri business unit before retiring in June 2022 as the conglomerate’s group head for research and development, sustainability, and projects.

He is also an active investor and has mentored unicorns such as Zetwerk and BlackBuck. He is also an independent director and board member at Zetwerk.

Rangrass has also made several investments in various agritech startups including Vegrow, Absolute Foods, Krishify, Farmart, Loopworm, and AgNext as well as in climate-focused companies such as Metastable Materials, and Wastelink.

Raj Nooyi will help Unitus’ portfolio companies to scale globally. He brings over 35 years of experience working with leading technology and services companies such as Hewlett Packard (HP), PRTM, Tata Consultancy Services and IBM.

In his previous stints, he led the design, development, and implementation of solutions to improve supply chains, accelerate product innovation and effect organizational change. He has also been associated with several non-profit organizations including Plan International where he served as the interim CEO.

“They will play a pivotal role in supporting our portfolio companies in their next phase of growth and international expansion. Rangrass' experience in agritech and sustainability will form the anchor for our investment strategy in the climate sector for our next fund. Raj brings global operating experience which will help our portfolio companies in their international expansion efforts,” said Surya Mantha, managing partner, Unitus Ventures.

Unitus Ventures, through its association with Capria Ventures, has invested in startups building asset-light solutions in climate and other domains. The VC firm’s portfolio includes Cuemath, Awign, Wify, Milaap, DriveU, and BetterPlace, among others.