The financial trading sector is a demanding environment—billions of dollars in multiple trades across markets, industries, and geographies, an increasing array of trade types, a massive transactions volume per second, involvement of an expansive cohort of brokers, fund managers and financial institutions conducted through an eclectic and ever-expanding mix of diverse channels.

Regulatory compliance in the sector adds another layer of complexity with many market intricacies and variations from state to state, country to country. Each region has its own particular set of policies and regulations.

Compliance with regulatory requirements is becoming demanding. Increased exposure, risk, and penalties + the explosion of messaging and media channels across the industry = another consideration. No longer is it phone calls and emails to capture.

It’s a Hybrid Paper -Digital Model

Data is the new oil, and it has a lifecycle of creation, archiving, record-keeping, reconciliation, analytics, and surveillance. Although we’re in an era of digital transformation, financial institutions often lag behind some of the more advanced industries in this area. This means, faxes, sticky notes, printouts, paper files, photocopies, and other legacy modalities of capturing communication often co-exist with the vast array of unified communication tools potentially available to users today. So how does a financial organization design a communication compliance process for a hybrid model that serves to close the compliance gap?

Technology-Paradoxical Twist

Interestingly, technology plays a double-edged sword here. In an instant, the pandemic shifted everyone to remote work beyond the traditional monitoring practices of compliance departments at the office and on the trading floor. Yet, at the same time, it introduced many new communication modalities and technologies to allow the 'Work From Home' situation to facilitate business and remote collaboration better. These new modes of communication, enabled by new technologies and often 'born-in-the-cloud', pose significant challenges for compliance, both in the ability to capture, retain, and analyze and the sheer volume of data these new channels produce.

Compliance Gap

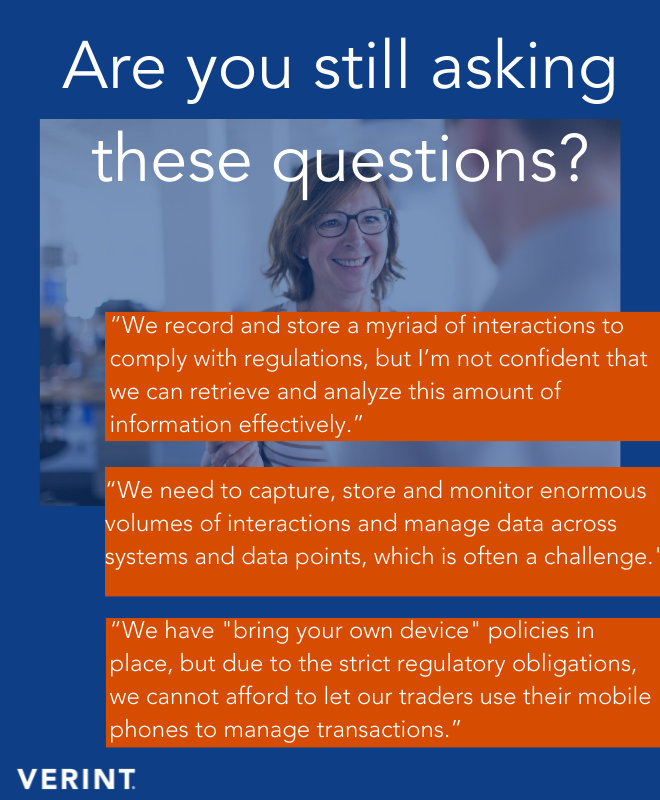

Having worked with several prestigious financial organizations, one question that is generally being asked, especially during a pandemic, is, “Our company is considering adopting new digital ways of communication. How can we exploit the latest collaboration platforms and the benefits of e-communication while remaining compliant?"

The biggest challenge is to capture, store, and monitor an enormous volume of interactions and manage data across systems and data points used by traders, front office and back-office personnel. To avoid compliance discrepancies, organizations often choose to play safe and restrict digital platforms, risking falling behind the competition.

The lack of secure, compliant communications should not be a bottleneck for your staff, and staff must eliminate the compliance gap.

Enable compliance across all your interactions

Verint Financial Compliance helps businesses remain compliant using a multi-channel and digitized communication environment. The solution can capture the ever-increasing variety of communication modes, including voice, IM, video, screen sharing, file transfer and other forms of content sharing.

Deployed at back-office, middle-office, and trading floor operations, Verint's solution suite enables communication compliance for leading platforms by Cisco, Microsoft, BT, IPC, and more.

Having a 360-degree approach for your organization’s communication compliance requirements will alleviate-

- Meeting regulatory demands

- Central recording of internal and external communication streams

- Manage and analyze large unstructured data sets

- Real-time dashboards and reporting

Financial Compliance also unlocks essential analytics capabilities that can speed up compliance investigations, recognize trends and help you verify prices, quotes, and trades.

Remain compliant, gain insights and be confident in responding to regulatory requests with a holistic compliance platform.