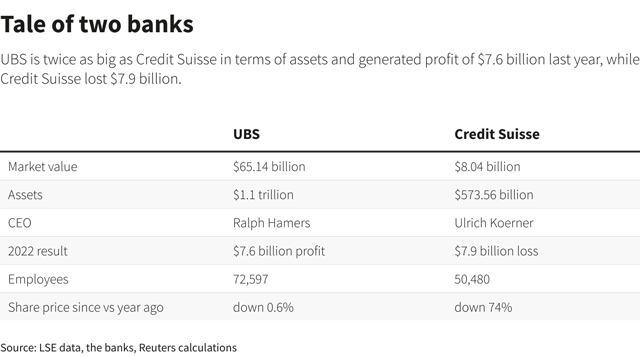

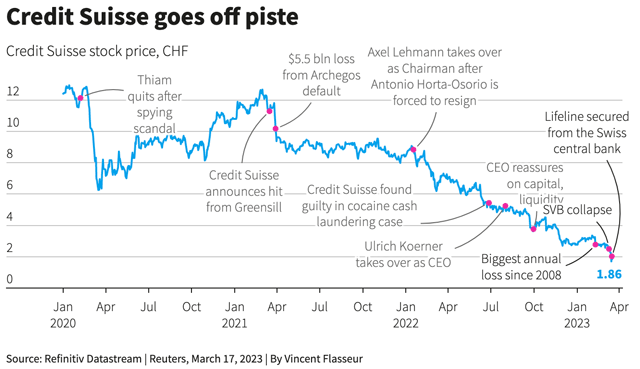

UBS agreed to buy rival Swiss bank Credit Suisse for 3 billion Swiss francs ($3.23 billion) and agreed to assume up to $5.4 billion in losses, in a shotgun merger engineered by Swiss authorities to avoid further market-shaking turmoil in global banking.

Developments

* U.S. Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen said they welcomed the announcement by the Swiss authorities to support financial stability.

"The capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient," they said in a statement, adding they have been in close contact with international counterparts.

* The deal includes 100 billion Swiss francs ($108 billion) in liquidity assistance for UBS and Credit Suisse from the Swiss central bank.

* The European Central Bank said on Sunday a Swiss rescue of Credit Suisse was "instrumental" for restoring calm on financial markets but it remained ready to support euro zone banks with loans if needed.

* The Bank of England welcomed moves by the Swiss authorities to support financial stability after UBS agreed to purchase Credit Suisse on Sunday and it said the UK banking system was well capitalised and funded. "The UK banking system is well capitalised and funded, and remains safe and sound," the Bank of England said in a statement.

* UBS Chairman Colm Kelleher said the bank wants to keep Credit Suisse's Swiss unit, speaking at a news conference announcing the merger between Switzerland's two biggest banks on Sunday. "It is a fine asset that we are very determined to keep and hopefully service their customers and clients as efficiently as Credit Suisse has done," Kelleher said.

Market reaction

* Early traded prices of the euro suggest the single currency was rising on the back of the news. The euro was last quoted at around $1.07, up around 0.4% on the day.

Max Georgiou, analyst, Third Bridge, London, said: "Today is one of the most significant days in European banking since 2008, with far-reaching repercussions for the industry. These events could alter the course of not only European banking but also the wealth management industry more generally."

Octavio Marenzi, CEO, OPIMAS, Vienna, said: "Switzerland’s standing as a financial centre is shattered – the country will now be viewed as a financial banana republic. The Credit Suisse debacle will have serious ramifications for other Swiss financial institutions. A country-wide reputation with prudent financial management, sound regulatory oversight, and, frankly, for being somewhat dour and boring regarding investments, has been wiped away.

Related news

* The U.S. Federal Deposit Insurance Corp (FDIC) is planning to relaunch the sale process for Silicon Valley Bank after failing to attract buyers in its latest auction, with the regulator seeking a potential break-up of the failed lender, according to people familiar with the matter.

One of the options under consideration by the regulator is a sale process for the private bank of SVB for which bids are due on Wednesday, according to one of the sources, who requested anonymity as these discussions are confidential.

* Four prominent U.S. lawmakers on banking matters said on Sunday they would consider whether a higher federal insurance limit on bank deposits was needed to stem a financial crisis marked by a drain of large, uninsured deposits away from smaller and regional banks. "I think that lifting the FDIC insurance cap is a good move," Senator Elizabeth Warren, a Democrat, said on CBS's "Face The Nation" program, referring to the Federal Deposit Insurance Corporation's current $250,000 limit per depositor.