Prime Minister Narendra Modi and the Reserve Bank of India want to make the country a cashless economy, as they defend the 8 November decision to withdraw Rs 500 and Rs 1,000 notes. But the move to suck out 86% of the currency in circulation has led to a cash crunch, damped consumer demand and hurt economic activity.

Modi and others in the ruling establishment say India can easily move toward becoming a cashless economy by increasing the use of digital payment modes such as debit and credit cards, Internet banking and mobile wallets.

But, this idea is not easy to implement in a country where Internet coverage is limited, not everyone has a smartphone—or knows how to use it—and where a large number of people don’t even have a bank account.

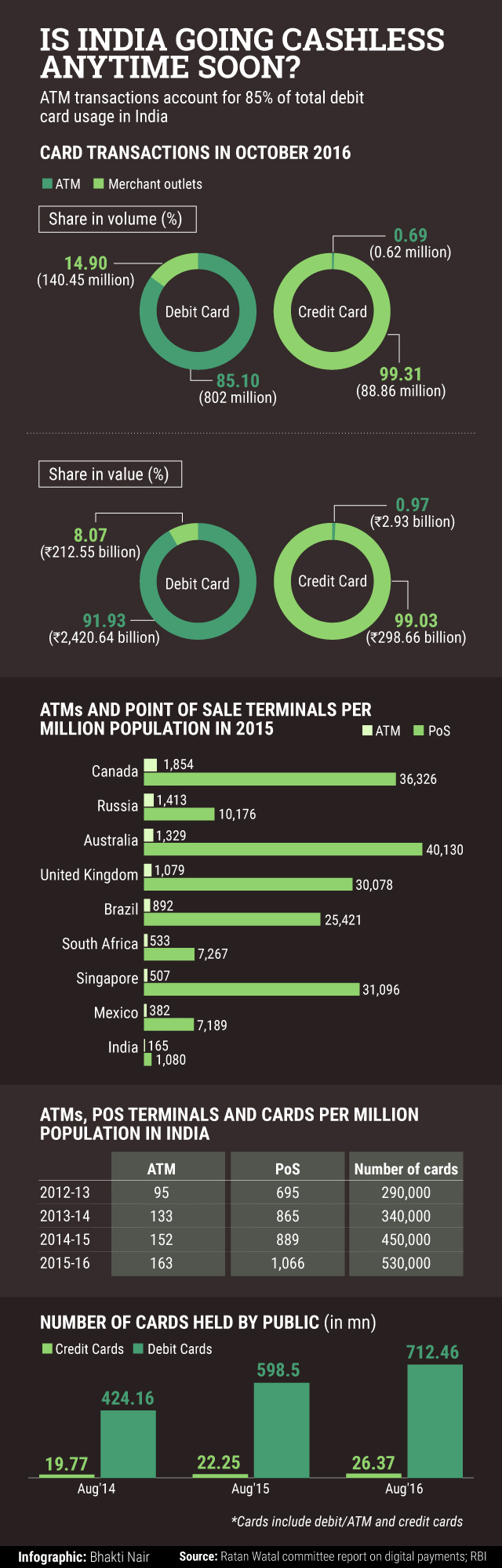

Of the three main digital modes—cards, net banking, mobile wallets—debit cards have the largest reach. The number of debit cards held by Indians was 712.46 million as of August this year, up 19% from a year earlier, official data show.

And what do Indians do with their debit cards? A small minority uses the cards at point-of-sale (PoS) machines to pay for products or services. A large majority uses the cards to withdraw cash from ATM machines.

In fact, cash withdrawal accounted for 85% by volume and 92% by value of debit card transactions in October, the month before the government embarked on its cashless drive. These numbers may have changed a little since the 8 November decision but the Reserve Bank of India hasn’t yet released related data.

Why do Indians use their debit cards mostly to withdraw cash? The reasons include a perceived tendency among buyers to overspend while paying by card and security issues. Also, most merchants don’t have PoS terminals.

In fact, India ranks far below developed economies such as the US and the UK and even its fellow emerging economies such Brazil, Russia and South Africa when it comes to the availability of ATMs and PoS machines.

To be sure, cashless transactions have risen over the years through debit cards and prepaid payment instruments such as mobile wallets. But when debit cards are used mostly to withdraw cash, then it maybe a little too early to talk about going cashless.

Like this report? Sign up for our daily newsletter to get our top reports.