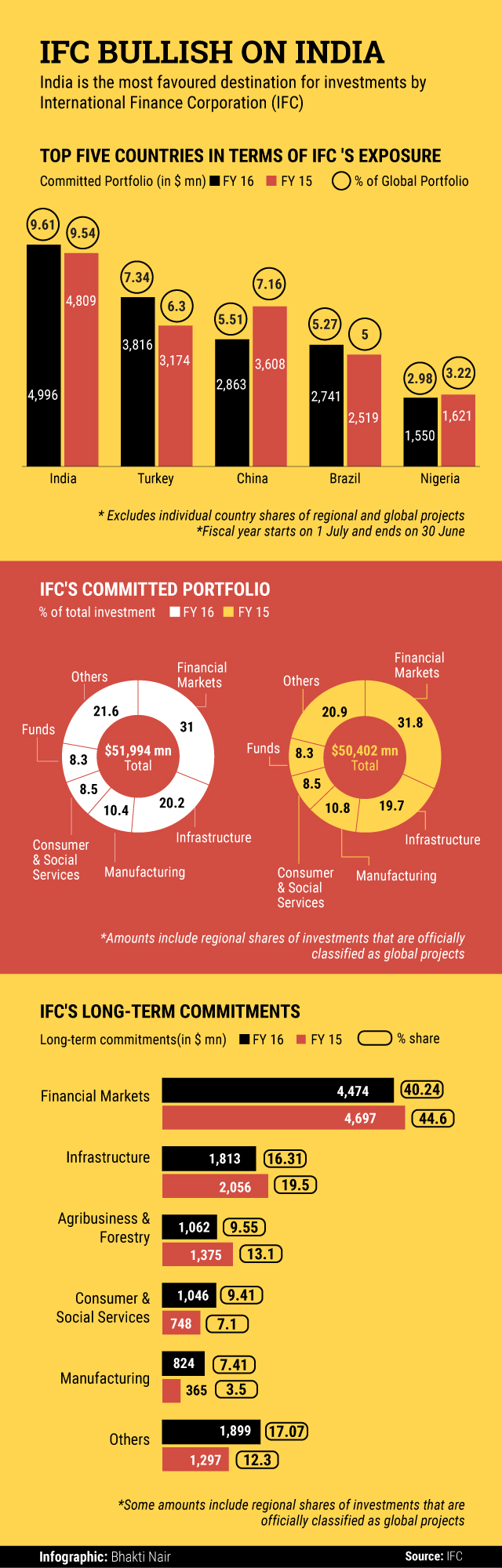

India continues to be the most favoured destination for the International Finance Corporation (IFC), the private-sector investment arm of the World Bank, data recently released as part of its latest annual report show.

IFC has a total India exposure of just under $5 billion, nearly a tenth of its committed global portfolio. During the 12-month period ended on 30 June 2016, IFC’s portfolio in India rose by $187 million, even as its exposure to China declined by $745 million.

However, its fresh committed investment in Turkey and Brazil was higher than that in India.

IFC, which typically invests in low-income and developing economies, continues to bet big on financial services besides infrastructure, manufacturing, consumer and social services among others. The firm is also a key Limited Partner (LP), or investor, in third-party funds including several Indian private equity and venture capital funds.

Some of IFC’s notable equity deals in India over the past few months included investments in eyewear e-tailer Lenskart, online grocer BigBasket, Bandhan Bank, Future Consumer Enterprises and S Chand & Company. It went particularly big on debt funding to non-banking finance companies and housing finance firms with lending commitment to IPO-bound PNB Housing Finance, Aptus Value Housing Finance, Aspire Home Finance, Capital First and YES Bank.

Like this report? Sign up for our daily newsletter to get our top reports.