The Pradhan Mantri Jan Dhan Yojana was launched in August 2014 to drive the government’s financial inclusion agenda. In recent weeks, however, concerns have arisen that the Jan Dhan bank accounts could have been used to launder black money, or money that illegally escaped the tax net, after Prime Minister Narendra Modi on 8 November announced his government’s surprise decision to withdraw Rs 500 and Rs 1,000 notes.

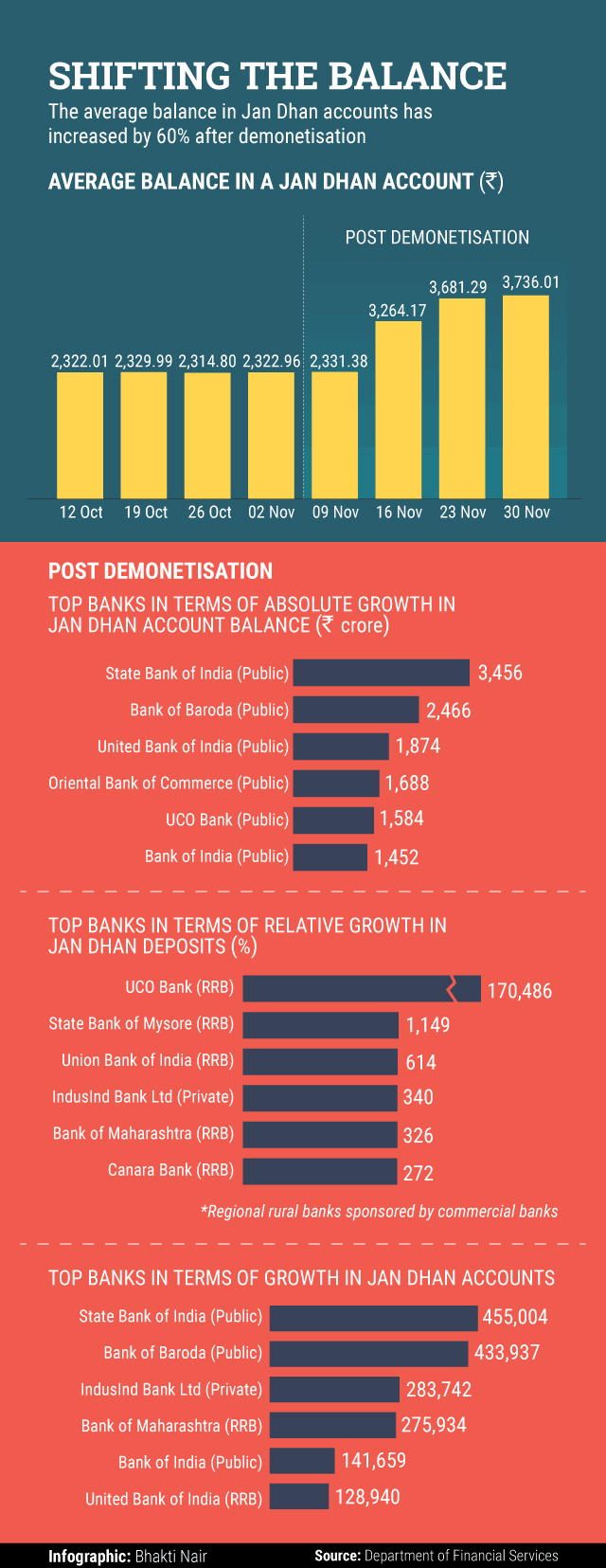

The concerns arose after deposits in the Jan Dhan accounts surged more than 60% between 9 November and 30 November to Rs 74,312 crore, finance ministry data show.

Some regional rural banks reported an astronomical increase. For instance, RRBs sponsored by state-run reported that deposits in their Jan Dhan accounts climbed from Rs 22 lakh to Rs 373 crore during this period. UCO Bank sponsors two RRBs—Bihar Gramin Bank and Paschim Banga Gramin Bank.

This surge in deposits prompted the government to warn people not to allow their accounts to be used by others for converting their black money.

This warning has led to a considerable decrease in the inflow of funds in Jan Dhan accounts, the government said in a statement on Wednesday. The government said the total deposits received in Jan Dhan accounts fell from Rs 20,206 crore during 8-15 November to Rs 11,347 crore during 16-22 November and to Rs 4,867 crore during 23-30 November and around Rs 400 in the first two days of December.

Like this report? Sign up for our daily newsletter to get our top reports.