Capital Float and Lendingkart Finance, two of India’s most-funded digital lending platforms for small and medium enterprises, recorded a rapid rise in revenue for the year through March 2017 but also fell deeper into the red.

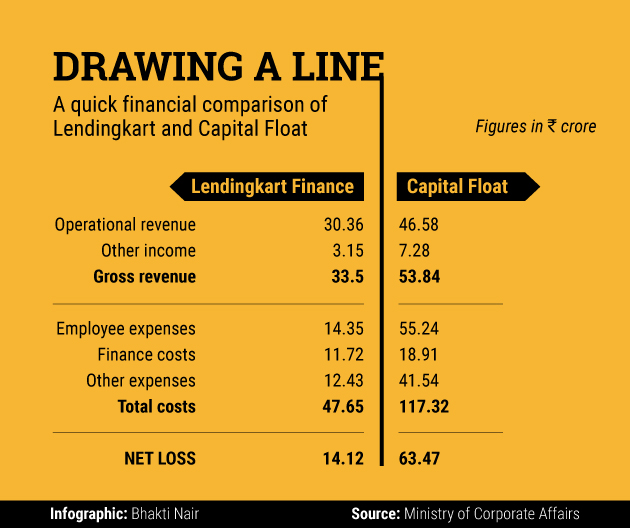

While Capital Float posted higher revenue than Lendingkart, it also burnt more cash and incurred a wider loss than its peer, according to a comparison of their annual financial statements filed to the Ministry of Corporate Affairs.

In other words, Capital Float lost more money on each rupee it made in operating revenue for 2016-17. Capital Float lost Rs 1.36 on each rupee in revenue, compared to less than half a rupee for Lendingkart.

The comparison takes into account the numbers clocked only by Zen Lefin Pvt. Ltd and Lendingkart Finance Ltd, the non-banking financial arms of Capital Float and Lendingkart Group, respectively. This is because the NBFCs run their core lending business, although both companies also have technology arms. Neither company responded to requests for comment on their financial performance.

Both companies have similar business models and both are expanding after raising millions of dollars from investors.

According to VCCEdge, the data research platform of VCCircle, Capital Float has raised $86 million in equity funding till date. This includes the $45 million it secured in August from investors including venture capital firms Ribbit Capital, SAIF Partners and Sequoia Capital India.

Lendingkart Group operates two entities – Lendingkart Technologies Pvt. Ltd and Lendingkart Finance. Lendingkart Technologies has mobilised a total of Rs 534 crore ($82 million) through equity (Rs 243 crore) and debt (Rs 291 crore), it said in September when it raised a bridge round.

Separately, Lendingkart Finance raised $15.9 million in October through equity and debt from IFMR Capital and other investors, and another $9.2 million from Lendingkart Technologies.

Top line, bottom line

Both companies’ operational revenue rose nearly five-fold in 2016-17. Capital Float’s top line grew to Rs 46.58 crore from Rs 9.45 crore the previous year while Lendingkart’s revenue rose to Rs 30.36 crore from Rs 6.15 crore.

Interest from loans and processing fees account for the major source of operational revenue for both these companies.

Capital Float’s gross revenue jumped four-fold to Rs 53.84 crore in 2016-17 from Rs 14.21 crore the previous year. Lendingkart’s gross revenue climbed five-fold to Rs 33.5 crore from Rs 6.15 crore.

Gross revenue includes income from other sources such as interest from fixed deposits. Capital Float’s other income rose 53% to Rs 7.28 crore while Lendingkart recorded a 9.4% rise to Rs 3.15 crore.

Both companies’ bottom line worsened. Lendingkart’s net loss widened more than three times to Rs 14.12 crore from Rs 3.7 crore and Capital Float’s loss more than doubled to Rs 63.47 crore from Rs 28.99 crore.

Burning cash

For both companies, the wider loss was due to a steep rise in expenses. Lendingkart’s total costs surged five-fold to Rs 47.65 crore from Rs 9.85 crore. In comparison, Capital Float’s expenses nearly tripled to Rs 117.32 crore from Rs 41.90 crore.

Like 2015-16, employee expenses and finance costs remained the major expenditure heads. Staff costs surged to Rs 14.35 crore from Rs 2.7 crore for Lendingkart and rose to Rs 55.24 crore from Rs 33.31 crore for Capital Float.

Finance costs—which include term loans from other than banks, loan processing fees and borrowing costs—rose, too. To be sure, this is not unusual given that their business involves borrowing from NBFCs as well as banks for underwriting the loans.

Lendingkart’s finance costs tripled to Rs 11.72 crore from Rs 3.77 crore. But Capital Float recorded an 11-fold rise to Rs 18.91 crore from Rs 1.64 crore. This likely indicates higher borrowings, translating into more disbursals during the financial year.

Other major expenses for Lendingkart include commission and brokerage at Rs 4.13 crore, licence fee at Rs 2.81 crore, provisions for non-performing assets at Rs 3.04 crore and loan write-offs at Rs 5.22 crore.

Capital Float’s other major costs include marketing expenses at Rs 5.32 crore, commission and brokerage expense at Rs 9.54 crore, customer on-boarding charges at Rs 2.85 crore and provision for NPAs at Rs 3.81 crore.