The Finance Minister (‘FM’) has today presented the Union Budget for 2013-2014 (Budget) before the Indian Parliament. Various amendments have been proposed impacting Foreign Institutional Investors (FII) – while some of them provide welcome relief in terms of reduction of operating costs and opening up further investment opportunities, others may increase tax burden. The key changes are discussed below:

Tax Rate

The base tax rate for short term capital gains [subject to Securities Transaction Tax (STT)] remains unchanged at 15% while long term capital gains (subject to STT) continues to be exempt from tax.

The FM has proposed an increase in rate of surcharge from 2 per cent to 5 per cent on tax which will impact corporate FIIs having total income exceeding Rs. 100 million. Therefore, short term capital gains would, henceforth, be taxed effectively at the rate of 16.22 per cent, instead of 15.76 per cent, resulting in increase in tax burden by 0.46 per cent.

Tightening of tax treaty benefit eligibility

Last year a provision was inserted in law providing that a Tax Residence Certificate (TRC) obtained from the Government of the relevant country would be necessary for a taxpayer to be entitled to claim benefits under the Double Tax Avoidance Agreements (tax treaty).

It is now proposed to amend the provision to state that such TRC shall not be sufficient condition, though necessary, to claim benefit under the tax treaty. The FM has not specified the conditions required to carry out a ‘sufficiency test’. In view of this change, the tax authorities may probe into eligibility to tax treaty benefits on various parameters rather than merely relying on the TRC.

Deferral of GAAR

The FM has proposed amendments in the General Anti Avoidance Rules (GAAR) on the lines decided by the Government in January 2013. The FM has proposed that impermissible tax avoidance arrangements will be subjected to tax after a determination is made through a well laid out procedure involving a Tax Officer and an approving Panel headed by a Judge. Further, as indicated earlier by the Government, GAAR is proposed to be applicable from financial year starting from April 1, 2015.

Reduction in STT

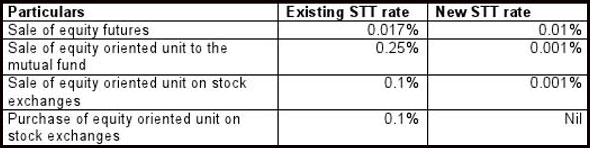

The FM has proposed reductions in the rates of STT :

The levy of STT on transactions in Shares and Options remains unchanged.

Withholding tax liability on redemptions – whether indirect transfer?

Last year, the law was amended with retrospective effect to state that an asset or a capital asset being any share or interest in a company or entity registered or incorporated outside India shall be deemed to be situated in India, if the share or interest derives, directly or indirectly, its value substantially from the assets located in India. However, the word ‘substantially’ was not defined. Doubts were raised regarding taxability on redemption to overseas unit holders/share holders.

To provide clarity on this point, the Prime Minister had referred it to the Expert Committee (Shome Committee).The draft report of Shome committee had recommended to clarify through a circular that the non-resident investor will not be taxable in India in relation to the investments made by the FII.

The tax proposals do not address this issue and, hence, the uncertainty continues as of now.

Easier window for portfolio investors

There are many categories of foreign portfolio investors such as FIIs, sub-accounts, Qualified Foreign Investors etc. and there are also different avenues and procedures for them. Designated depository participants, authorised by the Securities and Exchange Board of India (SEBI), will now be free to register different classes of portfolio investors, subject to compliance with KYC guidelines.

SEBI will simplify the procedures and prescribe uniform registration and other norms for entry of foreign portfolio investors. SEBI will converge the different KYC norms and adopt a risk-based approach to KYC to make it easier for foreign investors such as central banks, sovereign wealth funds, university funds, pension funds etc. to invest in India.

Participation in Foreign Currency derivatives

Presently, FIIs are not permitted to participate in exchange traded currency derivatives. The FM has now proposed to allow FIIs to participate in the exchange traded currency derivative segment to the extent of their exposure in rupee denominated portfolio in India.

Relaxation in collaterals

The FM has proposed to allow FIIs to use their investment in corporate bonds and government securities as collateral to meet margin requirements.

(The article has been authored by Sunil Gidwani-Tax Partner and assisted by Tushar Patel- Senior Manager, PWC – Tax and Regulatory Services, Mumbai.)

To become a guest contributor with VCCircle, write to shrija@vccircle.com.