Alpha Digital Health Pvt. Ltd which operates healthtech startup Mojocare, has raised $20.6 million (Rs 160 crore) in a Series A funding round led by B Capital Group.

The round also saw participation from existing investors Chiratae Ventures, Sequoia India’s Surge and Better Capital with angel investors like Vineet Jain (Times Group), Kunal Shah (Cred), Ankit Nagori (Curefoods), Adrian Auon (Forward), Sajid Rahman (Telenor Health), Ravi Bhushan (Brightchamps) and Vivekananda HR (Bounce).

The Bengaluru-based company will use the funds to expand its product, strengthen and diversify its product portfolio and scale across an omnichannel go-to-market strategy.

The company said it has registered 45 times growth in its paid subscriber base and delivered care to users across 50% of India's pin codes with a Net Promoter Score (NPS) of 60.

“In India, 400 million users are battling issues related to dermatological, mental health, fertility, and sexual wellness. Consumers have a lack of trust in physicians and access is severely limited due to a nearly non-existent care layer. The prevalence of unskilled and dishonest health professionals is alarming and the likelihood of counterfeit products being sold offline is considerable,” said Rajat Gupta, co-founder, Mojocare.

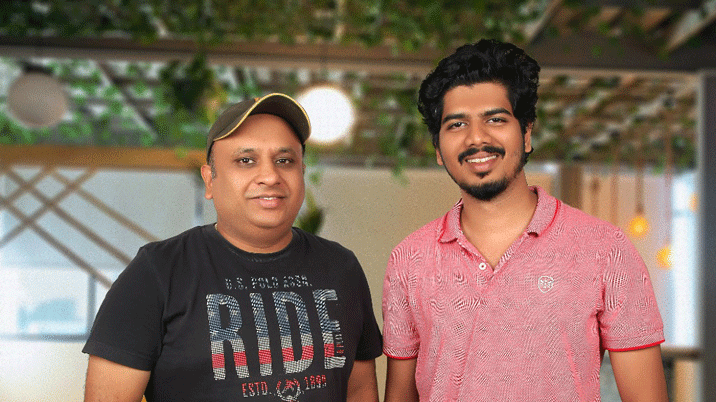

Founded in 2021 by Ashwin Swaminathan and Gupta, Mojocare offers personalized and full-stack care across sexual wellness, women's wellness, mental health and hair loss. In October 2020, Mojocare raised $3.08 million (Rs 24 crore) in seed funding from Chiratae Ventures, Sequoia India’s Surge.

“Despite the space seemingly being crowded, most of the players offer transactional experience, selling generic products on third-party marketplaces where they have no ownership over the user’s wellness journey. We are taking a distribution-first approach to unlock this latent market, said Ashwin Swaminathan, co-founder, Mojocare.

B Capital was founded by Raj Ganguly and Facebook co-founder Eduardo Saverin in 2014 and it invests out of a global fund across sectors. It had closed its second fund of $820 million in 2020. Last year, it also raised $126.3 million for a new vehicle called B Capital Ascent Fund II, LP. It has over $6 billion of assets under management.