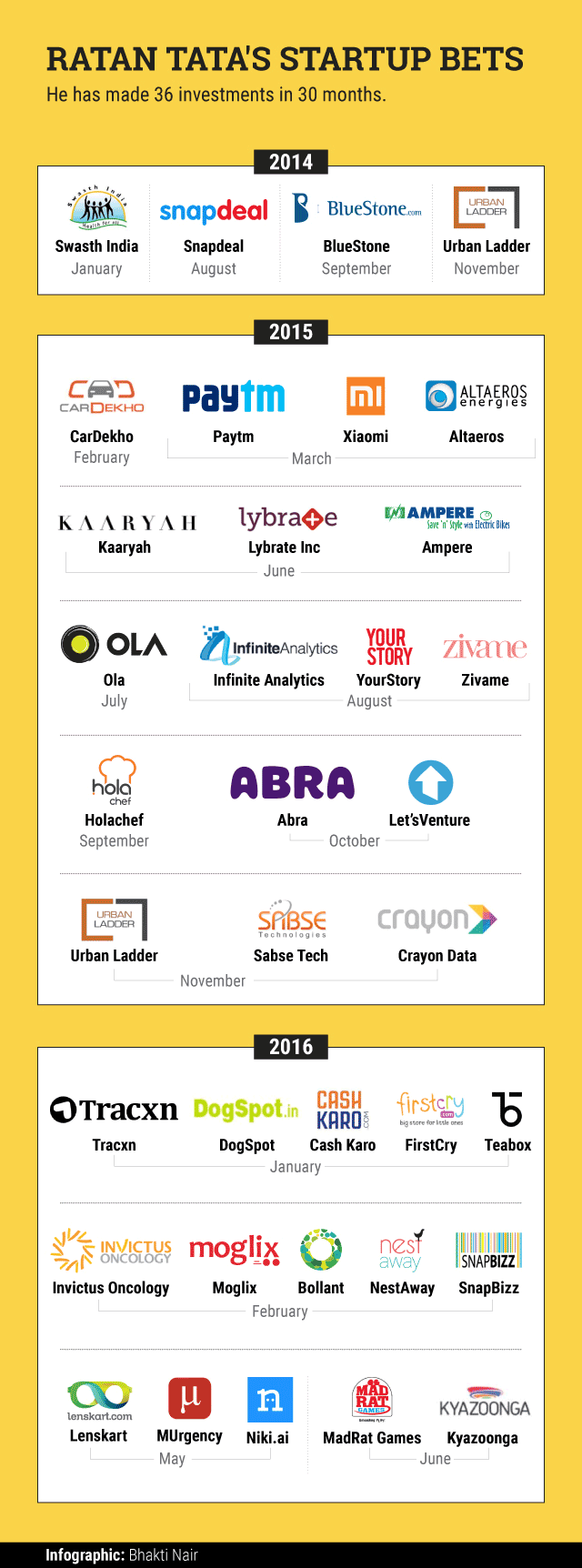

Ratan Naval Tata seems to have turned busier after retirement. He has backed three dozen startups, invested in seed and debt funds, floated a venture fund and also advised venture capital firms since retiring as the head of the Tata Group in December 2012. And the 78-year-old is showing no signs of slowing.

Tata, who is now chairman emeritus of Tata Sons Ltd, was the top angel investor by number of deals last year and is on track to remain so this year as well. He has bet on companies in sectors as diverse as the Tata Group itself, from Internet and IT to social enterprise, healthcare and manufacturing.

How does he do this? VCCircle spoke with a number of people, including founders of startups that received funding from Tata, to find out.

Tata invests mostly through RNT Associates Pvt Ltd, a Mumbai-based company that takes its name from his initials. While Tata himself makes the investment decisions, he is helped by a small team at the company’s offices in Mumbai and Singapore with correspondence, paper work and discussions.

The key person at RNT Associates is Ramachandran Venkataramanan, or Venkat as he is often called. The media-shy Venkat has been a long-time executive assistant to Tata. He had previously worked with Tata Communications Ltd and is currently a director at RNT Associates. He is also an executive trustee of the Tata Trusts.

Venkataramanan didn’t respond to a request seeking an interview for this article. But two people aware of the functioning of RNT Associates said that Venkat is the one who communicates the final decision on funding and works with the companies receiving investment from Tata on legal formalities.

Another director at RNT Associates is former Tata Sons board member RK Krishna Kumar. Widely known as KK, the trusted aide of Tata is a veteran of 50 years in the Tata group and was also managing director at Tata Tea and Indian Hotel Co. He is also on the board of trustees of some Tata Trusts. At RNT Associates, KK is involved in strategy and overall direction rather than day-to-day decisions.

The registered address of RNT Associates is in Colaba, Mumbai, but most of its staff works out of Elphinstone Building where the offices of Tata Trusts and some Tata group companies are located.

In Singapore, RNT Associates International Pte Ltd is also involved in making startup investments for Tata. The Singapore office has Patrick McGoldrick, a former managing director and CEO of Tata Technologies, as an executive director and Mathias Imbach as general manager in charge of business development. Imbach, a former Bain employee, joined RNT Associates in October last year. “It is a small team of professionals who directly report to (the) chairman,†Imbach describes RNT Associates in his LinkedIn profile.

How Tata picks startups

In January, Tata said in chat at the TiECON Mumbai 2016 conference that he seeks to invest only in startups that excite him and in teams who make a good first impression.

“I see it as a worthwhile experience, if the concept excites me. What do I feel of the founders? What is their first impression? Is he/she only in it for the short term? Does he/she have passion for the sector? I am a very numbers-driven person,†Tata said at the time.

But how do entrepreneurs approach him? There are broadly three ways people looking for funding can connect with Tata—through venture capital firms, key Tata group companies and executives who worked with Tata, and in some cases through direct correspondence.

“I wrote to Ratan Tata directly. I got a response from his secretarial team asking us to meet him,†said the founder of a venture who got funded recently. “We met Tata at Elphinstone Building in Mumbai. We were asked to make a presentation. He spent an hour with us; asked pointed, tough questions. He told us in the end that his team would get in touch with us,†this person said, asking not to be named.

In some cases, founders and ventures who are associated with Tata Group companies get introduced by group executives who personally know Ratan Tata. However, his investment decisions are independent of Tata Group’s business plans, said a senior executive at Tata Sons, the group holding company.

For instance, Tata has invested in online-to-offline eye-wear retailer Lenskart, which competes with Tata Group company Titan’s eye-care division. Similarly, Titan recently agreed to pick up a majority stake in online jewellery retailer Caratlane, which competes with Bluestone, a Ratan Tata portfolio company.

Investments via VC firms, new funds

Many startups get introduced to Tata through venture capital firms. Tata is an adviser to three VC firms—Kalaari Capital, IDG Ventures India and Jungle Ventures–and 14 of his 36 portfolio companies have been backed by one of these three firms.

Tata has invested in seven of Kalaari’s portfolio companies, including Snapdeal, Bluestone and Urban Ladder; four IDG portfolio companies including LensKart and NestAway; and Jungle Venture’s portfolio companies Crayon Data, Moglix and SnapBizz.

“It is true that VC firms do make an introduction. However, it is Mr Tata’s own decision whether to invest in a startup,†said another founder who received investment from him. “All portfolio companies (of the VC firm) were called for a meeting with him and he chose to invest in us,†this person added.

Tata has also done multiple co-investments with individual investors such as TV Mohandas Pai, Kris Gopalakrishnan, K Ganesh and Ronnie Screwwala.

Tata and RNT Associates have taken steps in forming a venture capital fund and supported a small debt fund as well. Tata’s fund in partnership with the investment arm of University of California has sought approval from the Securities and Exchange Board of India. The VC fund will invest in startups in India. An email query sent to the chief investment officer of the University of California seeking details did not elicit a response.

Last year, Tata invested in Grameen Capital’s social impact debt funding arm. Earlier in June, Jungle Ventures joined hands with RNT Associates and others to float a seed-stage VC firm in Singapore.

More than just money

Tata typically invests in the range of Rs 1-2 crore. He invested around Rs 2 crore in affordable healthcare venture Swasth India and Rs 1.35 crore in online furniture retailer Urban Ladder, according to VCCEdge, the data research platform of VCCircle. But the range could be wider; he is said to have invested Rs 10 crore in online marketplace Snapdeal and Rs 10 lakh in online lingerie seller Zivame.

Entrepreneurs who have received funding from Tata say his backing is mostly an endorsement of an idea and business model and that has helped many of his portfolio companies attract clients as well as future investments.

“Apart from his investment we will benefit from his expertise and time. His endorsement too will help us in a big way,†Suresh Shankar, co-founder of Crayon Data, said late last year when the startup received investment from Tata.

Indeed, Tata doesn’t bring only money. His experience in leading and building a 100-company conglomerate, his knowledge over a decades-long career and his deep industry connections are what young entrepreneurs a third his age value more.

Like this report? Sign up for our daily newsletter to get our top reports.