The past week has seen much controversy around the efficacy of the Narendra Modi government’s flagship scheme on financial inclusion ‘Pradhan Mantri Jan Dhan Yojana’ that aims to bring all unbanked Indians under the ambit of basic banking services in the country. Last week, The Indian Express reported that local bank branch officials had been depositing one rupee each in these accounts in a bid to bring down the number of accounts with zero balance.

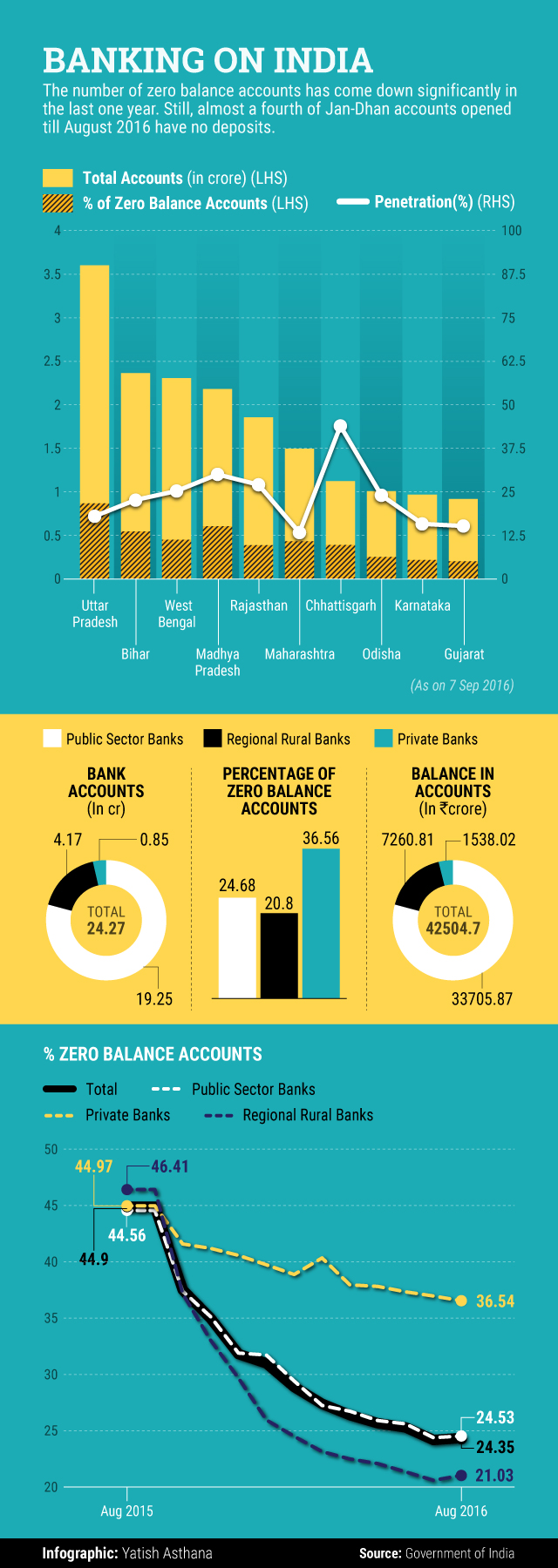

That so-called ‘one rupee trick’ to window dress the figures notwithstanding, the government’s data on the Jan Dhan scheme throw up some interesting insight. Data show that with almost 44% of its population having Jan Dhan accounts, Chhattisgarh has the best penetration rate in the country, more than double the national average of a little over 20%. Ironically enough, it is also the worst offender when it comes to zero balance accounts—with a little over 34%of such account holders having not made any deposits. Mizoram and Madhya Pradesh are the only other states where more than 30% denizens have Jan Dhan accounts.

Although private sector banks have opened less than a crore of the 24.2 crore Jan Dhan accounts in the country, they are the worst offenders when it comes to zero balance accounts, with more than three of every 10 account holders having no money.

Having said this, on an overall basis, the number of zero balance accounts has fallen. While in August last year, 44% of the counts had zero balances, the proportion is now down to a little under a fourth, with the rest holding more than Rs 42,000 crore.

Like this report? Sign up for our daily newsletter to get our top reports.