In an earlier column two months ago, I mentioned how the severity of the global financial crisis had taken everyone by surprise and how many more surprises may be in store in 2009.

The first big surprise in 2009 was the Satyam scam and it received all the attention it deserved. The second surprise, equally worrisome though hardly covered, was the news that retail sales fell in December 2008 for many leading retailers.

Consumer spending is the strongest link in India’s growth story, so for retail sales to not just slow down but actually drop, should send a chill down our spines.

Me and a couple of colleagues took a deep breath and dived into a jumble of statistics in an attempt to figure out what lies in store in 2009. Here’s the gist of what we came up with (forgive us our penchant for inappropriately placed Bollywood song titles and be grateful this column doesn’t have streaming audio):

1. GDP growth – Babuji dheere chalna, pyaar mein zara sambhalna

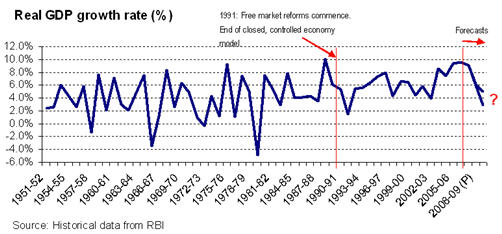

Ever since 1992, India’s real GDP growth has averaged a spectacular 6.5% and has never dropped below 3.8%. Over the past three years, it grew at a turbocharged 9% plus. However, India is now more integrated with the global economy than it ever was and we are caught up in the worst global recession in decades. We can not take GDP growth for granted.

Ever since 1992, India’s real GDP growth has averaged a spectacular 6.5% and has never dropped below 3.8%. Over the past three years, it grew at a turbocharged 9% plus. However, India is now more integrated with the global economy than it ever was and we are caught up in the worst global recession in decades. We can not take GDP growth for granted.

We split up India’s GDP into its eight large components and studied the historical growth rate of each component. Most components had contracted at some point or other in the past 16 years, but never together. Hence overall GDP growth has stayed well over 4%. For example, in 1994-95, even though the sector “Financing, Insurance, Real estate and Business services” (15% of GDP) grew at a slow 3.9% and the sector “Community, Social and Personal services” (13% of GDP) grew at a slower 2.3%, yet overall real GDP growth was a solid 6.4% because the Manufacturing sector (15% of GDP) grew at a sizzling 10.8% and the sector “Trade, Hotels, Transport and Communications” (28% of GDP) grew at a strong 9.9%.

In FY10, for the first time, many of these sectors may have a bad year together. The impact of the credit crunch, drop in demand from export markets and the reversal of capital flows affects most parts of the economy.

When we applied conservative growth rates to the different sectors of the economy and added up the result, we ended up with a GDP growth rate range of 2% to 5% for FY10; with the most likely estimate just under 4% in FY10. While GDP growth will slow down overall, some sectors of the economy, especially those categorised within Industry are likely to not just slow down but actually contract.

Most investment banks are currently forecasting FY10 GDP growth of 5%-7%. We feel they will likely revise their estimates downwards over time.

I remain a staunch bull on India’s long term growth rate, but in the short term, i.e. for FY09 and FY10, I believe we are in for a sharp slowdown. In an ever smaller world, we cannot hope to gain from the crests of the global economy without being impacted by its troughs. Welcome to the free market.

2. Growth capital – Pappu can’t dance!

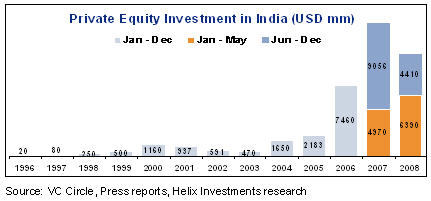

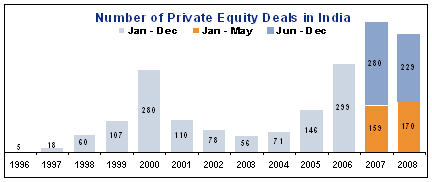

The Indian PE/VC industry has traditionally been dominated by growth capital transactions (and of late its foot-loose and fancy-free cousin – PIPE investments). But growth capital thrives only in an atmosphere of fast growth. Very few growth capital deals have closed since the demise of Lehman Brothers on that fateful September weekend.

The Indian PE/VC industry has traditionally been dominated by growth capital transactions (and of late its foot-loose and fancy-free cousin – PIPE investments). But growth capital thrives only in an atmosphere of fast growth. Very few growth capital deals have closed since the demise of Lehman Brothers on that fateful September weekend.

The drop in public market valuations has made PE/VC investors cautious in their outlook and very conservative with their valuation offers. Entrepreneurs have not yet reconciled to the valuations on offer and those with good liquidity and cash-generating businesses (just the kind that PE/VC investors like) are scaling down their growth plans and holding off on fund raising in the hope that valuations will rise again soon. Consequently, transactions are slow to close and likely will remain so for a few months at least.

The drop in public market valuations has made PE/VC investors cautious in their outlook and very conservative with their valuation offers. Entrepreneurs have not yet reconciled to the valuations on offer and those with good liquidity and cash-generating businesses (just the kind that PE/VC investors like) are scaling down their growth plans and holding off on fund raising in the hope that valuations will rise again soon. Consequently, transactions are slow to close and likely will remain so for a few months at least.

The last slowdown in PE/VC funding in India happened post the tech bust in 2000. That time, it took until 2004 for total deal value to reach 2000 levels and until 2006 for the number of deals done in the year to reach 2000 levels. While PE/VC investments will keep happening through 2009, it will be a long while before the pace of investments returns to the peak of 2007.

That being said, the slowdown in deal activity is not all that bad for investors. The best PE/VC returns in the past decade were made on deals struck in the 2000-2003 slow period. The PE/VC industry is likely to remember 2009 as being low on quantity but high on quality.

3. Buyouts – it’s the time to disco

Historically, buyouts in India have been few and far between. 2009 may go down as the year of buyouts. Conglomerates that have expanded too fast during the bull run are likely to consider divesting entire companies. Further, promoters that are personally over-leveraged may be forced to sell controlling stakes in their companies. Unlike in the West, buyouts in India are likely to use little leverage and will therefore not be LBOs but just BOs.

2009 could well see India’s first billion dollar plus PE buyout.

4. IPOs – Mere sapno ki rani kab aayegi tu?

The IPO window is definitely shut until the central elections in April/May and possibly for a few months post that.

5. It’s all about liquidity – Cash

2008 was not India’s worst year. 2009 will be. Businesses must hold on to cash to survive any negative surprises that come their way. India’s growth is underpinned by strong, long term trends in rising household savings, the world’s youngest work force and rising labour productivity; without a doubt, the economy will return to fast growth after this period of pain.

So long as companies can stay afloat during the slowdown, they can be sure of riding the inevitable upswing when it comes. So all entrepreneurs, investors, repeat after me (extracted from the lyrics of the Bollywood hit Cash from the movie Cash):

“cash to da left for me, cash is right for me

cash to da the front for me, cash is the back for me

cash is the day for me, cash is the night for me

cash on ma mind making money all da time”

No, no, Raju. That’s not what I meant …

Cyrus Driver is Director of a Mumbai based private equity firm. The views expressed are his own and not necessarily his organisation's. [With thanks to Raj Shastri and Sumit Tayal of Helix Investments Advisors for their research inputs.]